Gold surpassed $2,100 an ounce, a record. Time to sell? Or to buy? A confidential report from the Dutch bank ING offers some suggestions.

For gold, the market seems to be accelerating for two reasons: expectations on the monetary policy strategies of central banks and geopolitical tensions, to which is added the uncertainty for the future of the stock market. The result is that the yellow metal reached $2,146 an ounce in December. The previous record of $2,075 was reached in August 2020, when the world was grappling with the covid pandemic and rates were below zero. Since the beginning of 2023 the increase has been approximately 15%. The end of the inflation threat should push central banks to lower rates and buying gold seems like a good idea to many international investors.

The two ongoing wars in Ukraine and Israel contribute to pushing towards a diversification of investments into more defensive assets, such as gold. Added to this is the policy of the central banks which have increased their gold reserves. In the third quarter of 2023, for example, gold reserves increased by 337 tonnes. And in the first nine months of the year, central banks purchased 800 tonnes (+14% on 2022) of yellow metal, more than a third of the mining production in the same period, which was already a record. And among the central banks, the most active was the Chinese one.

Ing’s report

But will gold continue its run? A confidential report by the Dutch bank ING tries to answer this question. “We expect prices to remain above the $2,000 level next year as the global gold rush continues,” argue the authors, analysts Warren Patterson (Head of Commodities Strategy) and Ewa Manthey (Commodities Strategist). «We believe Fed policy will remain critical to the outlook for gold prices in the coming months. The strength of the US dollar and tightening central banks have weighed on the gold market for much of 2023. Higher rates are generally negative for gold” is the premise. “The latest US data shows that inflation and the labor market are cooling, with markets now pricing in a 50% chance of a rate cut in March and fully pricing in a rate cut in May.” This should support the rise in gold.

Even if the picture is not so schematic. For example, investments in gold-focused funds declined in 2023. Year-to-date, global outflows have amounted to $13 billion, equivalent to a 225-ton drop in reserves. Most of these sales came from European funds and North America. “Looking ahead to 2024, we believe we will see a resurgence of investor interest in the precious metal and a return to net inflows as gold prices rise as US interest rates fall,” Ing forecast.

Also pushing gold, as previously mentioned, is the central bank factor, which has increased its purchases, mainly China (+78 tons), Poland (+57 tons), Turkey (+39 tons) and India (+9 tons). China was the largest buyer of gold in 2023 in an 11-month buying spree. The People’s Bank of China has purchased 181 tonnes this year, bringing gold to 4% of its reserves. Not only that: in 2022 central banks purchased a record 1,136 tons of gold, compared to the 450 tons purchased in 2021, driven by the uncertainties caused by the war in Ukraine. One more reason, according to Ing, to continue supporting the value of gold to rise in 2024.

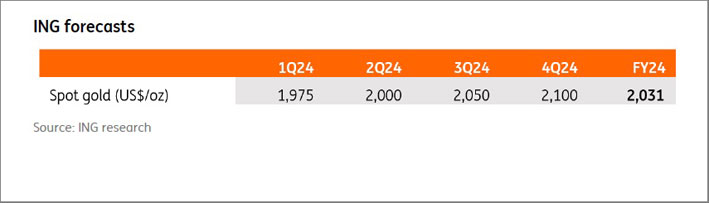

The prospects, however, according to analysts, are not to exceed the December 2023 record too much: «We expect gold prices to reach new highs next year and reach an average of 2,100 dollars per ounce in the fourth quarter, with an average of 2024 by $2,031 per ounce,” they write in the report. In short, the value of gold should remain high, around the levels of the end of 2023.