Pandora has named its industrial strategy Phoenix. But, rather than the mythical animal that rises from its ashes, it should call it Midas, like the Phrygian king who turned everything he touched into gold. The balance sheet data of the Danish group bear witness to this: in the third quarter of 2024, Pandora’s organic growth was 11%, made up of a Like-for-like growth (sales that take into account new or sold activities) of 7%, a network expansion of 5% and -1% due to the phasing of the sell-in, i.e. the supply to the retailer.

Growth in the main European markets was 4%, while the United States maintained +6% and the rest of Pandora’s markets continued to grow in double digits with an increase of 14%. Third-quarter gross margin reached 80.1%, up 11% from third-quarter 2023, supported by Pandora’s vertically integrated business model, price increases and cost efficiency.

Q3 EBIT margin was flat at 16.1%, down 40 basis points from third-quarter 2023, reflecting increased headwinds, including raw material prices and foreign exchange rates.

Net debt remains low, with a Net debt-to-EBITDA ratio of 1.5x. The combination of solid revenue growth and continued high profitability contributed to 17% year-over-year EPS growth in third-quarter 2024.

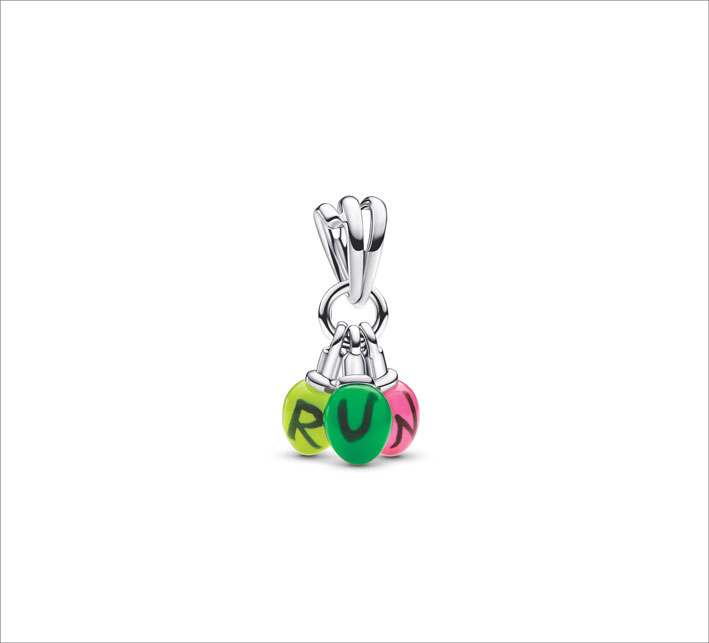

The Phoenix strategy is based on four pillars: Brand, Design, Markets and Personalization. Investments are yielding very positive results. The Core segment grew by 2%, while the Fuel with more segment achieved +21%, in line with Pandora’s Full jewellery brand vision. The Pandora Essence collection completed its first full quarter of life after its global launch in mid-Q2 2024 and generated revenue of 169 million Danish marks. Jewellery personalisation services are booming: engraving of rings, bracelets or pendants, grew by more than +100% in the quarter, with approximately 1,250 engraving machines installed globally.

We are very pleased with the strong results of this quarter, especially considering the current macroeconomic environment. We are transforming the perception of Pandora into a 360-degree jewellery brand and are embarking on a new chapter of our growth by attracting an ever-increasing number of consumers. Step by step we are seizing the many opportunities that had not yet been exploited and we will continue to invest in our strategic initiatives aimed at growth.

Alexander Lacik, President and CEO of Pandora

However, rising raw material prices are putting pressure of 3.6% on the 2026 Ebit margin target, set at 26-27%. Pandora confirms the implementation of mitigation measures to cover at least 1.4% of this impact and is actively pursuing further offsetting actions. The organic growth forecast has been raised to 11-12% (the upper range of the previous forecast, which was between 9% and 12%). The Ebit margin forecast remains unchanged at around 25%. October trading recorded sub-double-digit growth, in line with the underlying trends observed since the beginning of the year.