Tiffany has the same rating, that is, a judgment on solvency, as Italy: BBB+. According to Standard & Poor’s, in short, those who have purchased bonds of the world’s largest jewelry group have the same probability of getting their invested capital back as savers who have purchased bonds issued by the Italian state, i.e. Bot and Btp. In truth, Italy does not have BBB+ but only BBB, in essence it is a minimal difference. The prospects for Tiffany, in any case, are better than those of Italy: the outlook is, in fact, stable. The judgment on Italian debt, however, is negative. According to the largest risk assessment agency for investors, the reason for a stable judgment on Tiffany’s future lies in the fact that “its well-regarded brand, and geographic diversification will drive sales and profit growth. We see Tiffany as well-positioned in the highly fragmented and competitive global luxury jewelry and retail industry: its strong brand and geographic diversification support our assessment of the company’s business risk,” according to Mariola Borysiak, of Standard and Poor’s. “But Tiffany’s operations are sensitive to economic cycles and stock market volatility, as evidenced by declining profitability in fiscal 2008 and 2009.” In short, the risks are there: “Although unlikely, we could downgrade the rating next year if the company’s performance deteriorates due to a sharp downturn in the global economy with eroding sales and profits.”

Latest from news

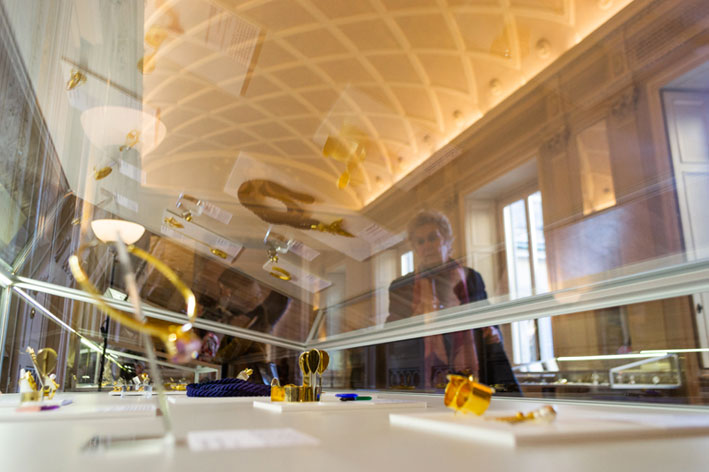

Milano Jewelry Week is back (October 15-20), with some new features, including creations on display and

What’s happening now? Those who have gold jewelry can rejoice: the yellow metal has broken all

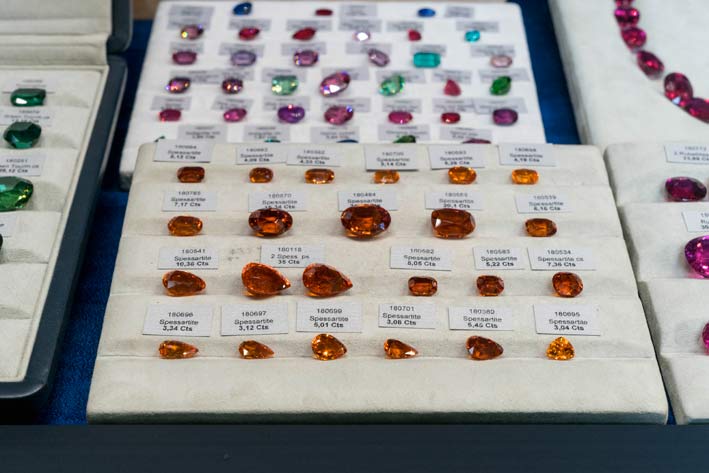

Vicenzaoro is also an opportunity to meet many jewelers. And it also happens that you exchange

One of the most respected gemological laboratories, the Swiss Gübelin Gem Lab, opens in Bangkok, Thailand.

Vicenzaoro September has closed, an edition that according to the organizing company, Italian Exhibition Group, recorded