Pomellato for sale. But it is not the founder Pino Rabolini who is selling: it is actually Federico Ghizzoni, CEO of Unicredit. Here is the story that Gioiellis.com is able to reveal.

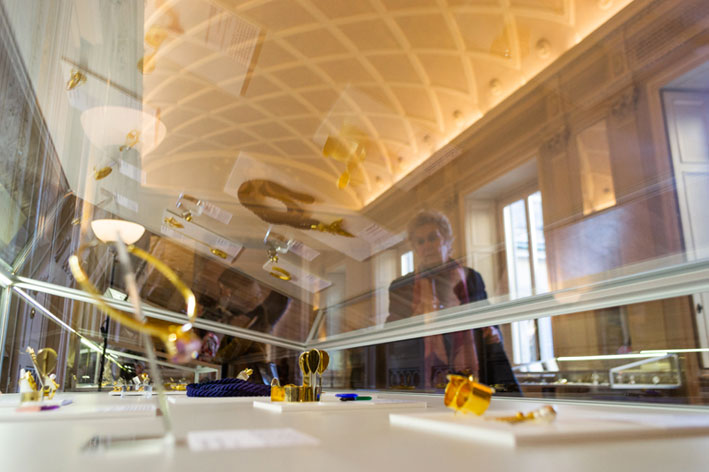

Pomellato spa, the jewelery company with 343 employees which also owns the Dodo brand, has a share capital made up of 10 thousand shares. Of these, 300 thousand are controlled by the vice-president Luciano Farina (3%), 1 million 800 thousand by the Luxembourg-based Sparkling Investments of the Damiani family (18%), 1 million 872 thousand by Pino Rabolini’s Ra.Mo (18.7%), also prudently under Luxembourg law, while over 6 million of the same Ra.Mo are pledged to Unicredit (60%). The financial form of pledge is often used as a form of collateral when very significant financing is granted. In essence, the bank led by Ghizzoni holds the majority of the jewelry group in its portfolio. Who knows if the manager is wearing a Dodo i Love you bracelet on his wrist.

Added to this is the already publicly expressed desire of the Damiani family to sell the share, albeit not under any conditions. The Damiani representative also voted against the approval of the 2011 budget at the last shareholders’ meeting. In a difficult situation like the current one, on the other hand, it is not easy to stay on the market. Furthermore, CEO Andrea Morante himself explained to the shareholders that the company is very dependent on the Dodo brand, especially in Italy, where the group invoices around 50% of its revenues. That the rumor of a possible sale is suddenly circulating again has, in short, almost the scent of an invitation to come forward sent through the kind collaboration of the press and the web, as the Gioiellis.com website reported a few days ago. After the 15 million in loans that expired in 2012, Pomellato must repay another 13 million to the banks this year, and 7 in 2014.

The operating company, Pomellato spa, had a turnover of 116.6 million in 2011, with a profit of 7.4 million. The valuation for a possible sale (perhaps Unicredit’s desire) would be around 300 million, which would be equivalent to a multiple of 20 times the 2011 margin.