Who said the clock is outdated? The numbers indicate the opposite, at least according to data relating to the Swiss watch industry contained in the ninth report Deloitte Swiss Watch Industry Study 2022: sales with e-commerce will double by 2030, and are 35 billion Swiss francs (as of moment the exchange rate is approximately at par with the euro and the dollar) of worldwide growth in the second-hand market. The survey was conducted among 70 senior watch industry executives and nearly 6,000 consumers in Switzerland, China, France, Germany, Hong Kong, Italy, Japan, Singapore, Switzerland, UAE, UK and USA .

Deloitte’s analysis underlines some interesting aspects: the majority (57%) of the executives of the Swiss watch industry interviewed expect a positive 2023 for the sector, even if in decline. But as of early 2022, more than three-quarters (77%) of executives predicted a rosy outlook. Furthermore, nearly 80% of watch industry executives say that geopolitical uncertainty caused by the war in Ukraine and tensions between China and the United States is negatively impacting the company’s outlook.

The United States continues to be the most important country for the Swiss watch industry in terms of export volumes (77% still expect growth), but India and China are gaining weight. However, expectations are different: for Hong Kong, the decline or stagnation is expected to continue, while only 57% of those interviewed believe that the market in China will grow.

The time of e-commerce

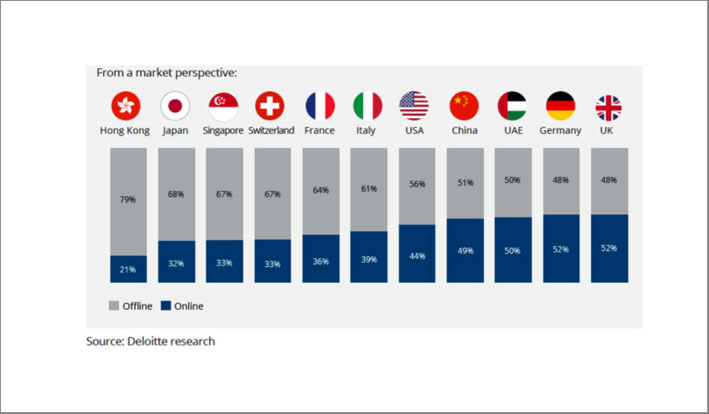

According to the report, 40% of consumers and 45% of respondents under the age of 40 are the most likely to buy online. The majority of Swiss watch industry executives believe that traditional stores will continue to be the most important sales platform in the foreseeable future. In Italy, for example, the shop remains the preferred place for 61% of consumers, but in Anglo-Saxon, Asian and even United Arab countries buying a watch online is increasingly popular.

With two in five consumers preferring to buy their watches online, it is imperative that brands expand e-commerce channels and expand their already rich offline offering to meet customer expectations. According to our estimates, the share of watches purchased online is set to double to 30% by 2030.

Karine Szegedi, Head Consumer and Fashion & Luxury at Deloitte Switzerland

Watches are always an investment

The report confirms the widespread opinion that a good watch is also an investment. 23% of consumers buy watches with the idea of reselling them: the business is especially popular in Singapore (33%), Hong Kong (32%) and China (29%). This also explains why consumers in some Asian markets are willing to spend more on new watches. In China, for example, more than a third (35%) say they are willing to shell out 5,000 Swiss francs or more for a new watch, while paradoxically in the home of watchmaking, Switzerland, the percentage drops to 8% and in France only 2%. Consumers who buy a watch as an investment obviously intend to sell it at a higher price (36%), but they also see watches as a way to diversify their portfolio (33%). Among the latter, Chinese consumers seem to be the most interested (55%).

The used market

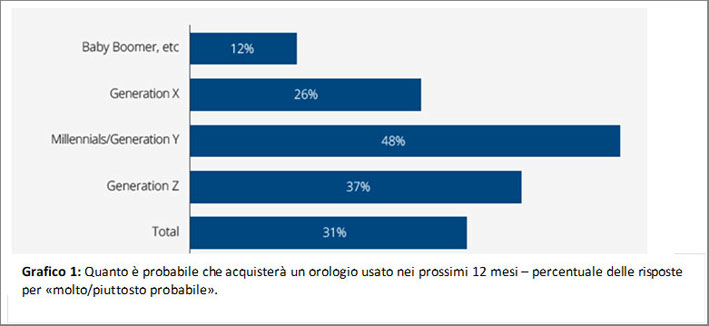

Sales have inevitably created a parallel market: a third of customers (31%) expect to buy a second-hand watch in the next year and companies are creating their own second-hand sales channels. Second-hand watches are increasingly popular, especially among millennials and generation Z: 48% of younger respondents are interested in a pre-owned branded timepiece, obviously because the price is lower (44%) than new, but also because a discontinued model can be found (29%). Not to mention that there are those (21%) who consider buying a second-hand watch for environmental reasons.

The growth of the used watch market does not worry the producers: 70% of the managers interviewed consider this phenomenon positive because it positively influences the perception and value of the brand. Deloitte expects the current market size of approximately 20 billion Swiss francs to continue to grow significantly over the next few years, to nearly 35 billion Swiss francs by the end of the decade, becoming more than half that to the new watch market.