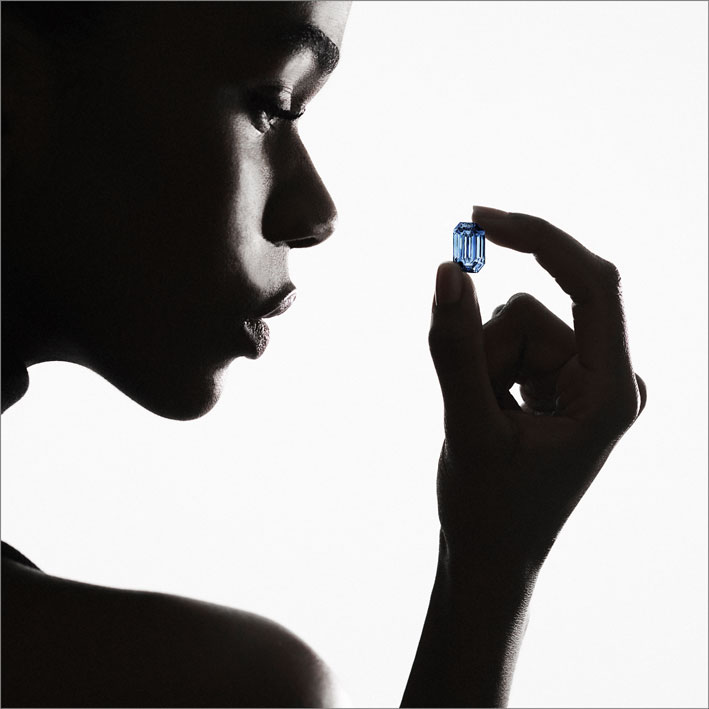

A golden 2024 for the Italian jewelry sector. However, 2025 will have a few less carats. The balance of the activity and forecasts for the near future are at the center of the meetings organized by the Club degli Orafi twice a year, on the occasion of the editions of Vicenzaoro. The one in January 2025, supported by the data collected by Intesa Sanpaolo, confirmed good results also in 2024, with a turnover growth of 5.7%. In a context, however, that sees industrial production at -7.1%.

Another data that emerged from the analysis is the boom in gold jewelry exports, in strong growth (+44.5% in value and +28.6% in quantity), thanks to the leap in sales to Turkey. But, be careful: it is a bubble ready to deflate. The acceleration was driven by high inflationary tensions in Turkey, which pushed up demand for gold (semi-finished products that are then transformed into ingots) and by the role of hub towards other markets assumed by this country. The proof is that net of exports to Turkey, sales outside Italy remained substantially stable.

A panel of Italian operators participated in the eighth joint survey by Club degli Orafi-Intesa Sanpaolo and confirmed a still positive 2024, but is more cautious with regards to 2025, with the percentage of respondents expecting a growth in turnover of 25% (down from 36% in 2024). Investment intentions are also slowing down, with only 21% of gold companies expecting an increase in 2025 (they were 46% in 2024).

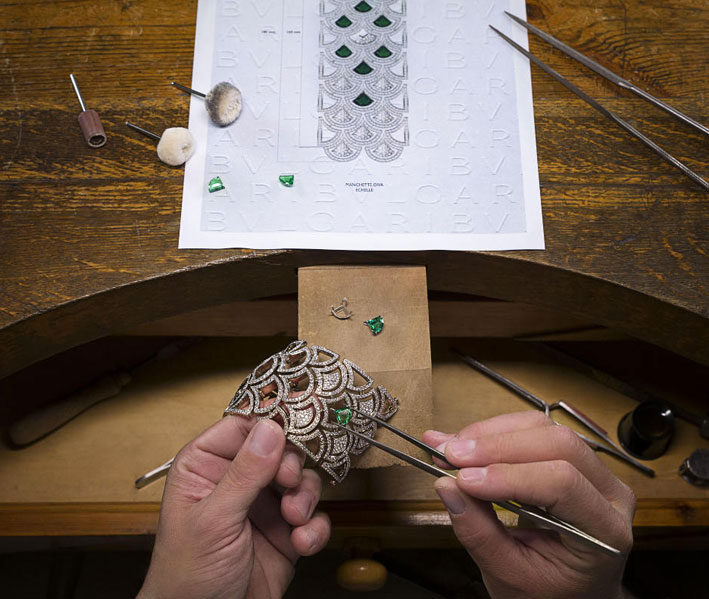

In this uncertain context, the analysis that emerged claims, the correct planning and management of the generational transition within companies plays a crucial role: from the analyses on the economic-income results, companies with young people on the board, compared to those who have not yet faced this process, appear more dynamic in terms of growth and are able to strengthen their productivity thanks also to a more advanced strategic profile (presence of international markets, presence of patents, brands, certifications and attention to renewables)

The companies interviewed in the survey dedicated to the topic of generational support confirm that it is a complex process that requires adequate preparation; in fact, the most widespread practice is that of progressive involvement in management (77%) followed by direct support of young family members (58%). Among the supports that companies require, the topic of training stands out (59%), followed by management and organizational consultancy (56%). Conclusions reached by the participants in the discussion: Laura Biason, general manager of the Club degli Orafi, Andrea Buccellati, honorary president and creative director of the Maison of the same name, Daniela Corsini, Senior Economist responsible for commodity research for Intesa Sanpaolo, Filippo Fusaro, director of the Ice agency office in Houston, Sara Giusti, economist at the Research Department of Intesa Sanpaolo, Licia Mattioli, CEO Mattioli, Maria Cristina Squarcialupi, president of the Club degli Orafi Italia and UnoAerre Industries, Alessandra Tognazzo, researcher and professor of Family Business, University of Padua, Stefania Trenti, head of Industry & Local Economies Research Intesa Sanpaolo, and Augusto Ungarelli, delegate of the Centro Studi Club degli Orafi and Past President Lombardi – Vendorafa and Club degli Orafi Italia.