Surprisingly, compared to the forecasts of almost all the experts, the price of gold has started to increase again in recent weeks. It is a prospect that few had foreseen. So now for many the question is: buy gold or sell? Better to hurry to the jewelry store to buy a gold ring before the prices rise again? Or is it better to take advantage of the moment and sell your jewels before prices drop? Which of the two choices is the right one? To know what to do, whether to buy or sell gold, whether in the form of jewels or (for those who have the possibility) in small ingots or coins of yellow metal, however, it is good to know one thing: the price of this asset is mainly determined by geopolitical choices.

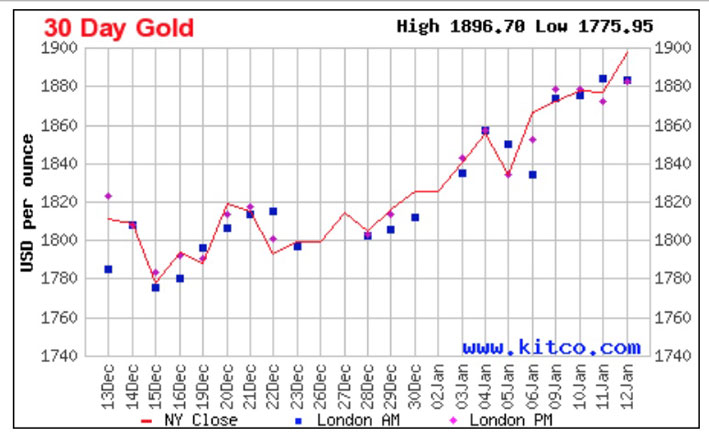

Historically, the price of gold rises when those with money in the bank or assets to use fear that wars, stock market crashes, high inflation, terrorism or other catastrophic events could put their wealth at risk. In that case, investing in gold is considered a choice to protect the property. For this reason, gold is considered a safe haven. Yet last year, despite the instability caused by the war in Ukraine (but not only) gold did not register the expected trend. In January 2023 gold marks an increase of just over 4.6%. Indeed, last year, in contrast to expectations, the price of gold fell a lot, after having exceeded $2,000 when the war broke out in Ukraine. Until autumn, when suddenly the price started to rise again. Prices in the last six months, in fact, mark +9.8%. Of this percentage, a large part relates to the last weeks of 2022 and the beginning of 2023: gold increased by 5.4% in one month. These data always refer to mid-January 2023.

Why, after surprisingly falling due to international tensions, did the price of gold rise so fast? And will it continue the race? The only certain thing is that the rise of the yellow metal is determined by two factors: the purchases of the central banks of Russia, China and some Arab countries. But not only. A large part of the purchases, for billions of dollars, take place in the shadows. In short, we do not know who is buying.

In mid-January, therefore, the price of gold is around 1,900 dollars an ounce (1 ounce equals 28.3 grams), with a 15% increase from November to mid-January 2023. Some buyers are known: the central bank Chinese announced purchases of 30 tons of bullion in December, but had already put another 32 tons in the vault the month before. Officially, the People’s Bank of China holds 2,010 tons of gold, equal to 3.4% of total world reserves. According to many analysts, China’s purchases could continue, pushing up the price of gold. But China is not the only country to shop for bullion: many other central banks are accumulating bullion: in the first nine months of 2022, world gold reserves increased by 673 tons, with a sprint in the third quarter, which recorded purchases for 399 tons.

Analysts’ accounts, however, lack 300 tons of ghost gold. Someone bought them, but we don’t know who. The China? Other countries acting in the shadows? The countries enriched by the sales of gas and oil? Perhaps. Many, for example, indicate Russia as the buyer, who however would prefer not to advertise the purchases. The reason would be linked to the sanctions: Russia is a major gold exporter, but today it is unable to sell it and, therefore, the State buys it to support the mining sector.

But, in short, buy or sell gold?

As long as the international situation remains tense, amid war in Ukraine and symptoms of an economic downturn, many central banks and investment funds will probably see fit to set aside some bullion. Added to this is that the sanctions against Russia are probably intended to drain the flow of gold on the market: less yellow metal in circulation also means prices that tend to rise. This does not mean that the price of gold will continue to rise like a cake in the oven: historically after large increases the price of gold decreases, even if in the last 20 years the value of gold has increased by 561%. But at the moment the situation is this. Whether the price of 1900 dollars an ounce is convenient to buy or sell therefore depends on the time perspective of your investment.