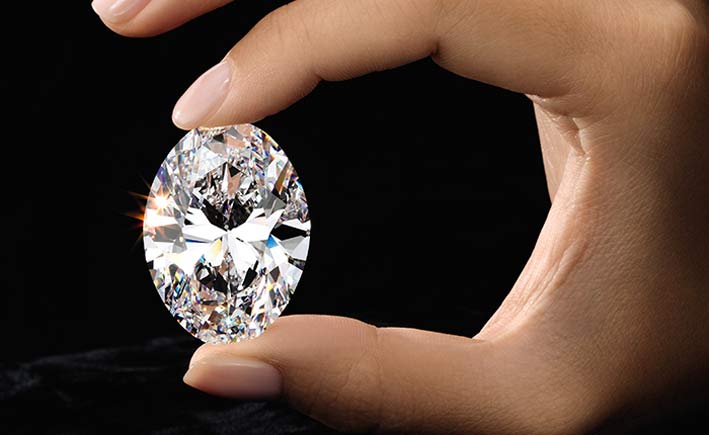

In the Mood for Love is the title of a film from around twenty years ago, an unresolved love story set in Hong Kong in the 1960s. A film that fascinated by its dense and romantic atmosphere. But In the Mood for Love is now also a special sale of fine jewelry, in view of Valentine’s Day but which will continue until February 289, organized by Christie’s. The sale features a selection of high-end gemstones and jewellery, including a 10.03-carat Fancy Vivid Yellow heart-shaped diamond necklace and a 5.06-carat heart-shaped diamond ring.

Rings with colored diamonds are also available, such as a ring with a 1.03-carat orange-yellow fancy intense oval-cut diamond and one with a 0.82-carat heart-cut pink diamond. Prices range from £15,000 to £500,000. Rings, earrings, necklaces and bracelets are displayed in Christie’s salon in King Street, London. Pieces are available for immediate purchase.