Invest in jewelry? Allocate your savings to rings, necklaces and bracelets? It is a question that repeats itself. The reason is: the stock markets go up, go up, go up. Then, at a certain point, they fall. The yields on bonds are at their lowest and when they are at their highest it is because there is inflation that decreases their yield. In short, for those with savings to invest, choosing is never easy. So, is it a good idea to invest in jewelry? And is investment in jewelry right for you?

The idea of investing in jewelry has a basis: in recent years (even if 2020 was conditioned by covid) the jewelry auctions of large companies such as Sotheby’s and Christie’s have shown rising prices. But be careful: the jewelry market is volatile and, in some cases, opaque. According to experts, large jewels and precious stones may be a good choice in the long run, but they do not guarantee an increase in value. According to what Laurence Nicolas, global managing director of jewelry and watches for the Sotheby’s auction house said some time ago, what has changed in recent years is the level of prices they reach.

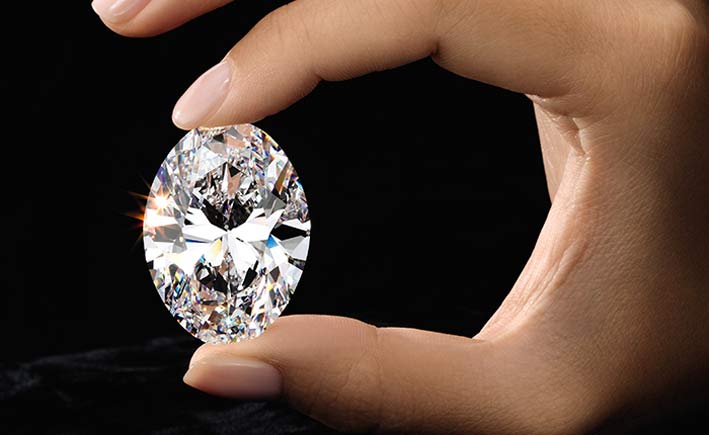

Invest in diamonds

In 2017, global demand for diamonds hit a record high of $ 82 billion, according to the De Beers annual diamond report, up from $ 80 billion in 2016. Alrosa, in 2020 the online sales of diamond jewelry have almost doubled, reaching about 20% of the total. Diamonds are considered, like gold, a safe haven asset. But beware, their value doesn’t always grow. As with other materials, their value can also drop. Then there is the problem of selling. While gold is easily sold to specialized shops or to a goldsmith, for diamonds it is generally a bit more complicated.

Furthermore, even diamonds are subject to fashions: today consumers are increasingly eager to buy rare and colored diamonds, fancy, and a little less traditional colorless gems. There is only one problem: the most precious ones (pink, blue, yellow) cost a lot. Also because only one in 10,000 diamonds is colored, according to the Gia diamond classification laboratory.

Investing in precious stones

There are not only diamonds. Gemstones are increasingly popular. Rubies, emeralds and sapphires have seen sharp price increases in recent years, according to the Bonhams auction house. There are particularly rare and in demand stones. Based on the auction results, it turns out that Kashmiri sapphires reported a 970% increase in price in the ten years to July 2018. And a similar increase, of 1,100%, concerns some examples of Burmese rubies. The same goes for Colombian emeralds, the most precious. The problem is that these stones now cost a lot. But it may be nice to know that if you have a ring with a Kashmiri sapphire at home you can sell it at a high price.

Invest in jewelry

Jewelery is also subject to cyclical trends. For ten years, according to Knight Frank’s Luxury Investment Index, the performance of jewelry assets outperformed that of the New York real estate market, gold and US equities. But in 2018, the index fell by 5%. Also because global sales of jewelry partly follow the global economic trend. And it is precisely when money is scarce that those who have jewels try to sell them: the moment, however, is the wrong one.

The weak point, however, when considering jewelry as an investment, concerns modern jewelry. Maybe in 30 years they will be in great demand at auctions, but for now it can be very difficult to recover an investment. In short, modern jewels can be worn and enjoyed, but it is rare to sell them even just to receive the money spent on the purchase. Excluding from this reasoning pieces with stones of exceptional value. This does not mean that one should not buy contemporary jewelry, but only that it is more difficult for a bracelet or a ring made today to be re-evaluated soon.

Investing in vintage jewelry

As for the jewels of the recent past, certain eras are more attractive. Art Deco jewelery from the 1920s and 1930s and those of the following decades are in fashion. Jewelery from that period signed by prestigious Maison such as Cartier and Van Cleef & Arpels are highly appreciated and are less subject to the whims of fashion. Even the jewels of the sixties and seventies begin to be considered period pieces and revalued, provided they are of excellent quality. Also according to the evaluation of auction house experts, the prices of Art Déco and Belle Époque jewels (from 1890 to 1915) increased by 72% between 2007 and 2018. Antecedent pieces, i.e. late nineteenth century, are less considered , at least in recent years.

How to buy jewelry for investment?

Let’s start from a concept: a jewelry store obviously adds a mark-up on the cost of the jewel. In short, it’s fine to buy a jewel to give as a gift, but don’t expect to close a good deal. And this also applies to vintage jewelry purchased in the store: in this case too, the markup of the jeweler can be high. The alternative is to choose a jewel in the many auctions held every year. But in this case the problem is finding the right price. To embark on a jewelry purchase at auction, you need to be an expert. If you are not, the best thing is to consult the auction catalog well in advance and conduct a preliminary research on the pieces that interest you regarding the prices of similar jewels beaten in the most recent auctions: they can offer an idea of the market valuation. But be careful: remember that auction houses also charge a commission, which will increase the final sale price. In short, the true cost is not the one established at the time the beater’s hammer drops. Another way to understand the true value of a jewel is to rely on insurance companies, even if the price provided by an independent appraiser employed by an auction house is not an absolute guide to determining how much the jewel might sell later. . In short, the ingredients of the recipe for investing in jewelry are many: it takes an eye, choosing high quality jewelry, with beautiful precious stones. And a little luck.