The price of gold dropped significantly, before stopping. How come? There is also a curious explanation: it was Chinese mothers who blocked the price drop with massive purchases aimed at creating rich dowries for their daughters. At least, this is the thesis of the “South China Morning Post”, a Hong Kong newspaper. The newspaper quotes Cheung Tak-hay, president of the gold and silver exchange of the former British colony, according to whom «the speculators’ plans have been ruined by buyers from all over the world, like Chinese mothers , who jumped at the opportunity presented by the low price.” In fact, China’s gold consumption rose to 320.54 tonnes in the first quarter of 2013, an increase of 26% compared to the same period of 2012. The data released by the China Gold Association highlights how purchases of Gold bars rose 49% to 120.39 tonnes, while jewelery bars rose 16% to 178.59 tonnes. Gold intake from China, the world’s largest producer of the yellow metal, rose 11% to 89.91 tonnes.

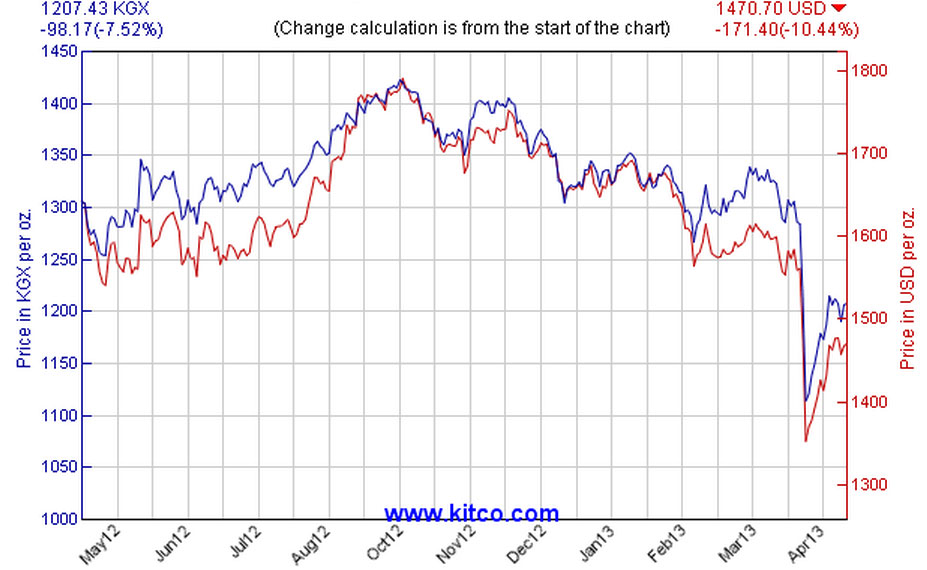

The price for an ounce of gold fell 9.1% in April to $1,321, its lowest point since 1983. Massive buying, many of which took place in China, brought gold back to $1,500. dollars. “We like gold and the price is good,” Zhu Tingting, a thirty-year-old professional from Shanghai who bought a large quantity of the metal, told the newspaper. Market operators interviewed by the newspaper claim that the speculation hoped to bring the price down to $1,300 an ounce. The price of gold reached its peak of $1,920 in 2011.