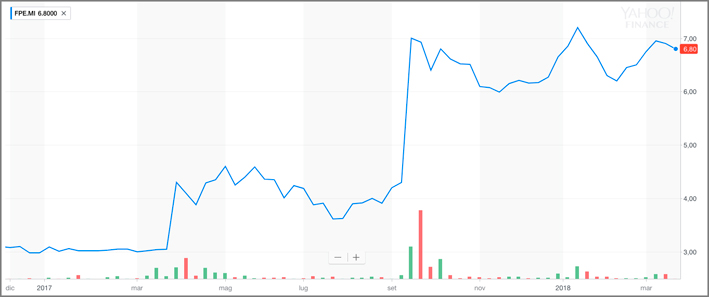

Pandora adds a jewel balance to its history: in 2022 it sold 103 million pieces in its 6,500 stores in a hundred countries. It was a positive year for the Danish group, with organic growth of 7% for the equivalent of 3.5 billion euros and an Ebit margin (Earnings before interest and taxes, basically a gross profit) of 25.5% and a net profit equivalent to 675 million euros. Over 600 million people have visited shops and online stores. Results that are even more positive if we count, for the fourth quarter of 2022, the loss estimated at around -1% caused by the fire at the European distribution centre. On the other hand, the company counted on a 4% network expansion. However, the Pandora accounts disclosed by the group underline the negative sales in the United States (-7%), while in Europe the growth was 2%. The company’s financial report also includes a positive gross margin (+0.5%). Ebit in Q4 2022 was 32.5%, an increase of 2.8 percentage points compared to Q4 2021 and with good cost control. For 2023 Pandora expects organic growth between -3% and +3% and an EBIT margin of around 25%.

We closed 2022 in style. Despite the macroeconomic pressure on consumers and the covid-19 turmoil in China, we continue to post solid growth from pre-pandemic levels. We have started 2023 well and are confident that the brand transformation that has taken place in recent years puts Pandora in a good position to handle future adversity and emerge stronger than before. In 2023, we will continue to execute on our strategy, capture market share and accelerate network expansion, while taking prudent cost actions to protect margins.

Alexander Lacik, President and CEO of Pandora

The group’s balance sheet also shows good financial solidity, with a rather low exposure and strong liquidity. To the happiness of the shareholders, alongside the dividend (DKK 16 per share) Pandora has anticipated a new share buyback program of DKK 2.4 billion until June 30 with the intention of reaching up to DKK 5 billion, with the objective of supporting the share price on the Stock Exchange.