Is it worth buying jewelry even if inflation is high? Conversely, if inflation continues is it a good idea to see the jewels? And maybe it’s time to buy gold to hedge against rising prices? If you ask yourself these questions, read this article: we try to answer them, but with a premise: be wary of those who tell you they can guess the future. There has never been a human being who knows, for sure, how things will go, Nor an astrologer, a psychic, but not even an expert on anything. That said, some trends can be identified with relative certainty. So, with prices rising, is it worth buying (or selling) jewelry?

The price of gold

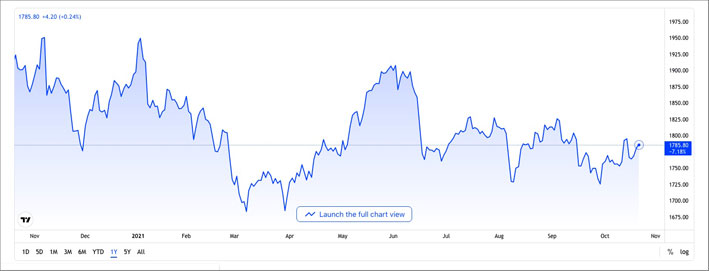

Let’s start talking about the yellow metal. Because it is obvious that buying or selling jewels or bijoux of little value are not an investment and inflation changes little. The value of an 18-karat gold jewel, i.e. containing 75% gold (the rest is made up of different metals: pure gold is 24-karat), will instead be more linked to the trend of the yellow metal on the markets international. So, given that 2022 was a year with high inflation in Europe and the US, and many other countries, how did the price of gold fare? Let’s answer immediately: not very well. But not too bad either. The graph, updated to December 2022, offers a concise answer. If you want to understand why gold hasn’t followed inflation, read on.

You must first know that the price of gold depends above all on the trades on the international market. Gold is mainly traded on the London market, the US futures market and the Shanghai Gold Exchange. The largest producers of gold are China, Australia, the United States, South Africa, Russia, Peru and Indonesia, while the largest consumers of gold jewelery are India, China, the United States, Turkey, Saudi Arabia, Russia and the United Arab Emirates. Therefore, when you buy or sell a gold jewel you must take into account that the price summarizes an average of those determined in many different countries. If, for example, China’s economy slows down due to the restrictions decided to deal with the covid, Chinese women will buy fewer jewels and, probably, the price of gold will fall. By contrast, gold jewelry purchases have increased in the United States. It is an extreme synthesis, but it is to give an idea.

In addition to this factor, i.e. the performance of the economy in countries such as China, inflation in 2022 also caused an increase in interest rates. This means two things: government-issued bonds (more or less in all countries) with higher yields and, for the United States, a stronger dollar (for the same reason, that is, for more attractive interest rates for investors, who buy dollars driving up the price). However, according to the World Gold Council, all in all the gold price has held up quite well, taking these negative factors into account. In December, the price of gold in dollars per ounce (which corresponds to about 28 grams) was more or less 1% lower than 12 months earlier. Compared to the stock market indices, which fell much more, it therefore held up better.

How will it go in the coming months? The price of gold is often linked to geopolitical factors. Gold is considered a safe-haven asset, which is bought when there is a lot of uncertainty. The war in Ukraine or other factors of international instability can push gold purchases. If, on the contrary, the world is a little less dangerous, the price of gold will probably tend to fall. Another factor that could affect the price of gold in 2023 is, as mentioned, the interest rate factor. Both the American and European central banks have announced further rate hikes. If this is the case, many will prefer to buy dollar or euro bonds rather than yellow metal. Conversely, a climate of instability could push central banks to buy themselves large quantities of gold to reserve. Furthermore, if the stock market falls further, many investors could be tempted to seek shelter in assets considered safer, including gold. But as we wrote: be wary of those who say they know how to read the future, but take into account the macroeconomic scenarios.

Is it worth buying gold jewelry?

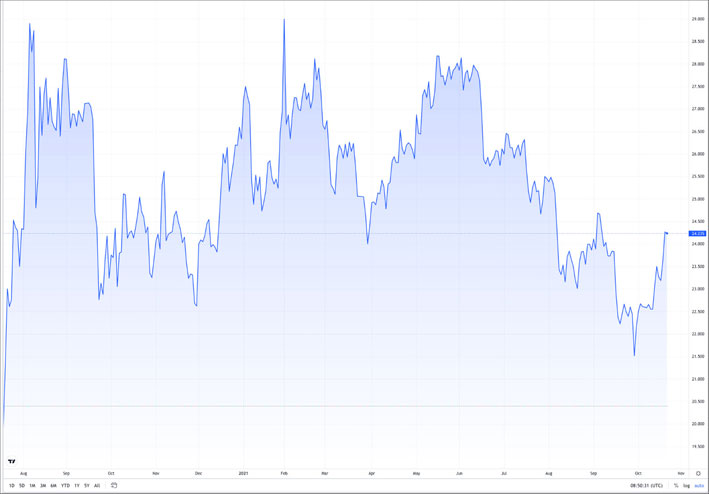

Inflation looks set to linger for a while longer. And if you take a look at the charts published on this page you will notice that gold has risen a lot in the last 20 years: it was quoted at around 250 dollars at the beginning of the new century and now it is somewhere between 1700 and 1800 dollars. but it hit 2000 a couple of years ago. In 2016, however, it was just above $1,000. This will tell you that gold is not a safe investment (there are no safe investments), but that it has held high levels over the last 10-15 years. Impossible to establish whether it will increase further or decrease in the next few years. But it is possible that it will still remain well above $1500. We translate: if you buy 18-karat gold jewellery, better still it would be 22-karat, you can have a good chance of protecting your purchase from inflation or, at least, of keeping a good part of the investment. With a little luck you could even make money if the yellow metal returns to the high levels of a few years ago. But even selling your jewels can be convenient, if you bought them before 2008 when gold was much cheaper (and if you bought them at a fair price, of course).