New management structure for Pandora. Massimo Basei is the new Chief of Retail Operations of Pandora. The Italian manager has been promoted (he was General Manager, Southern Europe, Middle East & Africa) and will report to CEO Alexander Lacik, and will also be part of Pandora’s Executive Leadership Team. The Danish company also announced that its nine market clusters will now report directly to CEO Alexander Lacik. Not only that: the Chief Commercial Officer Martino Pessina resigns.

The organizational change is explained by the company as an evolution of the long-term growth strategy of Pandora, Phoenix. Having rebuilt the company’s operational foundation, the brand is now turning its focus outward to further accelerate brand desire and deliver a world-class customer experience. The change will allow for greater concentration and faster decision-making.

Basei will be responsible for global retail operations across Pandora’s 6,500 stores in more than one hundred markets. This includes network expansion, franchise relationships, omnichannel experience, store development and global merchandising.

We are pursuing our high-speed growth strategy as reflected in our strong financial performance. With this change, we accelerate our efforts to deliver an even better experience to millions of customers around the world. I am delighted that Massimo is taking on the role of Chief of Retail Operations. Over the past 13 years, he has made Italy one of Pandora’s largest markets and has built an exceptionally strong position for the brand. I thank Martino for taking important steps forward in our retail operations, expanding our network of stores and evolving our omnichannel approach.

Alexander Lacik, CEO of Pandora

Basei joined Pandora as country manager for Italy in 2010 and then became responsible for Southern Europe, the Middle East and Africa. He currently lives in Milan with his wife and three children: they will move to Copenhagen during the year. The manager holds a master’s degree in economics from the University of Trieste. Sara Bergiotti, currently commercial director of the Southern Europe, Middle East and Africa cluster, will assume the position of general manager of the cluster.

Pandora’s revenues shine

Pandora adds a jewel balance to its history: in 2022 it sold 103 million pieces in its 6,500 stores in a hundred countries. It was a positive year for the Danish group, with organic growth of 7% for the equivalent of 3.5 billion euros and an Ebit margin (Earnings before interest and taxes, basically a gross profit) of 25.5% and a net profit equivalent to 675 million euros. Over 600 million people have visited shops and online stores. Results that are even more positive if we count, for the fourth quarter of 2022, the loss estimated at around -1% caused by the fire at the European distribution centre. On the other hand, the company counted on a 4% network expansion. However, the Pandora accounts disclosed by the group underline the negative sales in the United States (-7%), while in Europe the growth was 2%. The company’s financial report also includes a positive gross margin (+0.5%). Ebit in Q4 2022 was 32.5%, an increase of 2.8 percentage points compared to Q4 2021 and with good cost control. For 2023 Pandora expects organic growth between -3% and +3% and an EBIT margin of around 25%.

We closed 2022 in style. Despite the macroeconomic pressure on consumers and the covid-19 turmoil in China, we continue to post solid growth from pre-pandemic levels. We have started 2023 well and are confident that the brand transformation that has taken place in recent years puts Pandora in a good position to handle future adversity and emerge stronger than before. In 2023, we will continue to execute on our strategy, capture market share and accelerate network expansion, while taking prudent cost actions to protect margins.

Alexander Lacik, President and CEO of Pandora

The group’s balance sheet also shows good financial solidity, with a rather low exposure and strong liquidity. To the happiness of the shareholders, alongside the dividend (DKK 16 per share) Pandora has anticipated a new share buyback program of DKK 2.4 billion until June 30 with the intention of reaching up to DKK 5 billion, with the objective of supporting the share price on the Stock Exchange.

Pandora increases prices and sales

To Pandora, a character from Greek mythology, Zeus entrusted a vase, with the warning never to open it. But curiosity was stronger and Pandora freed among men all the evils enclosed by the gods in the box. The jewelry manufacturer Pandora, on the other hand, does not have these problems: growing sales and profits come out of her box. The latest data refer to the third quarter of 2022. The Danish company recorded organic growth of 3% and a growth in sales of 1% compared to the third quarter of 2021 (+ 13% organic growth towards the corresponding period of 2019, pre-covid). Other data: Pandora’s largest product platform, Moments, recorded 2% growth compared to the third quarter of 2021. Diamonds by Pandora (synthetic diamond jewelry) launched in North America on August 25 and reached a share 3% sell-out.

But, despite everything, the United States recorded a 3% decline, as a result of the end of post-covid government subsidies, which evidently also served to buy jewelry. On the other hand, the United States recorded strong organic growth of 56% compared to 2019, in line with last quarter. Mixed signals from the UK and Australia, which recorded double-digit organic growth compared to 2021, while France is suffering from the impact of reduced promotional activity. And while Germany is doing well, Italy has seen some signs of weakening consumer sentiment.

Our growth path continues into the third quarter and we are ready for the November-December commercial peak with a fantastic product line-up. The launch of Diamonds by Pandora has been encouraging and new products will soon be added to the platform to fuel the holiday season. Despite the macro-economic and geopolitical uncertainty, the purchasing habits of our customers have remained substantially unchanged. Thanks to our financial strength and our position in the affordable gifts industry, we are well equipped to cope with a potential recession and to seize the most important investment opportunities, for example to expand our store network. We are already taking precautionary measures to ensure our profitability should circumstances change.

Alexander Lacik, President and CEO of Pandora

It should also be noted that Pandora has raised the prices of some selected items in North America, while remaining in the affordable jewelry range. A similar price increase (4% on average) was implemented globally at the beginning of the fourth quarter: inflation does not spare the jewelry. From a financial point of view, it holds the gross margin. Finally, Pandora expects organic growth of 4-6% and an EBIT margin (gross profits) of 25.0-25.5% for the whole of 2022.

Brilliant quarter for Pandora

It seems that jewelry is going through a golden moment, even when almost all of its production is in silver. A pun to introduce the first quarter accounts of Pandora, the world’s largest company in the industry. Therefore, in the first three months of 2022 Pandora recorded strong organic growth + 21% compared to 2021 and + 18% compared to the corresponding period in 2019. The clarification is useful, because 2020 and 2021 were marked by the pandemic and, therefore, from an uneven sales trend. According to the company, it is all thanks to the strategy decided by the top, which also has a name (the strategy, not the top): Phoenix. It is essentially based on four principles: brand development, design, customization and focus on the US and China.

We are very satisfied with the excellent start of the year, with the revenue record in the first quarter. All of our product platforms support growth in Q1, which means that our ability to continuously deliver innovation pays off. The execution of the Phoenix strategy continues at a high pace and I am convinced that we still have many opportunities for growth ahead of us. Over the past two years, we have invested in building a strong organization, and this is increasingly visible in the numbers and in the way we lead the company.

Alexander Lacik, President and CEO of Pandora

In detail, the Pandora ME platform grew by 132% compared to the 2021 quarter and reached a 3% share of sales. Sales increase in the United States by 7% (62% compared to 2019) and with a plan with the acquisition of 32 franchise stores located mainly on the West Coast, as well as the start of a new partnership with Macy’s. On the other hand, however, the data in China were not positive and all business activities with Russia and Belarus were suspended: these are markets that represent approximately 1% of revenues. In the rest of Europe, on the other hand, the performance of the main markets marks double-digit positive organic growth compared to 2019 (UK and Italy both grew by over 30%). Online sales also performed well, also thanks to last year’s lockdown effect.

However, the company also reports some critical points, due to the negative impacts of the war, the increase in costs, higher interest rates and the aftermath of Covid-19. For 2022, in any case, organic growth is expected at 4-6% (previously 3-6%), while the guidance of the Ebit margin (the gross margin) remains unchanged at 25.0-25.5%. But, Pandora warns, financial guidance for 2022 is subject to high uncertainty.

Those who also follow the economic aspect of the jewelry market will be interested in the financial results of Pandora, a Danish giant with a worldwide presence. The accounts of Pandora also reflect, in part, the dynamics of the jewelry market.

That said, in 2021 the organic growth (i.e. excluding any extra operations) of the group was 23% compared to 2020 (which, however, they recall, was marred by numerous pandemic lockdowns). The Ebit margin (earnings before interest expense and taxes) of 25%. Data that exceeded forecasts. In particular, business has been booming in the US (+ 58% compared to 2020), while in China it was only 5%, in Italy by 10%, in France by 5%, in Great Britain by 14%.

It should be noted that the total revenues, at 23.3 billion Danish kroner (about 3.1 billion euros or 3.58 billion dollars), are higher not only than the sales of 2020 (19 billion), but also those of 2019 before pandemic (21.8 billion crowns). Sales that generated profits of 4.1 billion crowns (550 million euros or 630 million dollars).

We finish 2021 on a high note with record Q4 revenue and sell-out, and I am delighted that we are able to increase our revenue target for 2023 by approximately DKK 2 billion. I am particularly pleased that our growth has been strong in all key markets. Our digital investments are clearly paying off, Moments is showing solid growth, and we’re encouraged by new product platforms like Pandora ME and Brilliance. With this – and with the acceleration of network expansion in 2022 – I am confident that we have all the ingredients to generate sustainable and profitable revenue growth for years to come.

Alexander Lacik, president and CEO of Pandora

Which jewels are the jewel of such a positive performance? Pandora does not think about single jewels, but about what she calls “platforms”. In short, a sort of maxi collections that are periodically updated with new pieces. Notably, the Moments platform continues to generate very good results, including the Christmas collection. The relaunch of Pandora Me has been well received, with growth of 57% compared to the initial launch in 2019. But Pandora’s revenue is also driven by online sales, with organic growth of 91%, as far as the latest is concerned. three months, compared to the corresponding period 2019. For those who are also a shareholder of Pandora, the company proposes the distribution of a dividend of 16 Danish crowns per share, but also a new share buy-back program (a buy-back) for 3.3 billion Danish kroner, which should support the value of the shares.

Pandora’s strategies

News for Pandora supporters. But, in this case, not for fans of modular bracelets and pendant collections. The news concerns who instead of the jewels of the Danish Maison bought his shares. In fact, the company announced its new financial goals and provided further insights into its growth strategy, called the Phoenix, as the mythological animal that rose from its own ashes. Although, in truth, it does not seem that Pandora is in a position to be resurrected.

In any case, Pandora is aiming for organic growth of 5-7% CAGR (Compound annual growth rate) in the period 2021-2023. The company also expects total CAGR revenue growth of 6-8%, bringing revenues to 24.8-26.2 billion Danish kroner in 2023 (3.2 billion euros)

• Pandora expects EBIT margin to increase to 25-27% in 2023

• The share buyback program for 3 billion Danish kroner (390 million euros) is also increasing

• Pandora invests DKK 1 billion in expanding production capacity by around 60%. To strengthen supply resilience, most of the capacity will be built in Vietnam

We are pleased to confirm that Pandora is back on the path of growth. We have vast untapped opportunities in our existing core business, which will drive sustainable and profitable growth over the long term. Our goal is to be the largest and most desirable brand in the affordable jewelry market. And we have a solid foundation for achieving this.

Alexander Lacik, President and CEO of Pandora

Pandora also provided new insights into the Phoenix strategy. On May 4, 2021, Pandora announced the completion of its turnaround program, Now Program, and provided a high-level overview of its new growth strategy, Phoenix. Phoenix focuses on the significant opportunities in Pandora’s core business and has four pillars that aim to deliver sustainable and profitable revenue growth: brand, design, personalization and key markets.

The new details of the strategy:

· Pandora sees ample growth opportunities in its core markets. The long-term ambition is to double revenue in the US and triple revenue in China, both from 2019 levels

Pandora will personalize its customer experience by implementing a series of omnichannel functions. The company will also launch a new concept store

As the world’s most recognized jewelry brand, the ambition is to fuel the brand’s desirability and extend its reach to conquer Gen Z and Millennials

Pandora has three clear brand and design priorities: lead the core (Moments), launch new platforms and establish support models dedicated to each platform (“launch and leverage”)

· Pandora will continue to invest in a digital future. Today, 75% of Pandora’s transactions are direct-to-consumer, and customer data analytics will fuel future growth

To meet anticipated demand and increase our risk resilience, Pandora will expand its production capacity by approximately 60% or 80 million pieces of jewelry annually. A new plant with a capacity of approximately 60 million pieces will be built in Vietnam, while an additional additional capacity of approximately 20 million pieces will be added to the existing plants in Thailand. The total investment is approximately 1 billion Danish crowns

Pandora will continue its leadership in sustainability and announces ambitious new decarbonisation goals and an inclusion and diversity strategy. The new commitments include:

– Reduce greenhouse gas emissions by 50% in its operations and in the value chain by 2030, compared to 2019 levels. The goal has been approved by the Science Based Targets initiative. Pandora is also committed to becoming “net zero” by 2040

– Ensure gender balance in all hiring and promotions. ii) Have 1/3 women in leadership (VP level and above) by 2025 and full gender equality by 2030. iii) Spend 30% of the budget on branding content with suppliers owned by women or underrepresented groups .

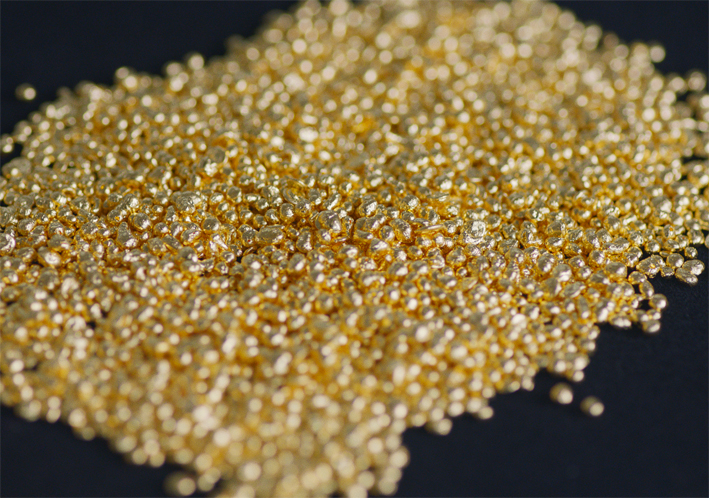

It is a choice that some large Maison already have done, to which Pandora is now added: by 2025 the Danish brand will completely stop producing its jewels using freshly extracted gold and silver and will only purchase recycled resources. This will reduce carbon dioxide emissions by two thirds for silver and over 99% for gold.

The choice is important, also because the quantity of precious metals used by Pandora is more impressive than that of high jewelery brands, which sell few pieces at a higher price. Pandora, on the other hand, distributes thousands of charms, bracelets, rings and earrings all over the world.

Gold and silver are splendid materials that can be recycled indefinitely, without losing their quality. The metals extracted centuries ago are still as good as new. They will not oxidize and will never be ruined. We hope to help develop a more environmentally friendly processing method and prevent these precious metals from ending up in landfills. We want to help build a more circular economy.

Alexander Lacik, CEO of Pandora

Today, to tell the truth, 71% of gold and silver from Pandora jewelry already comes from recycled sources. But a complete use of unextracted gold and silver will reduce carbon dioxide emissions, water consumption and reduce other environmental impacts, since the recycling of precious metals uses less resources than the extraction of new metals. The carbon dioxide emissions generated by the supply of recycled silver are one third of those generated by the extracted silver, while the recycling of gold is equivalent to a quantity of carbon dioxide emissions 600 times less than that derived from the extraction of gold , according to life cycle assessments.

Silver is the most used material in Pandora jewelry and, based on weight, it represents more than half of the materials purchased. Pandora also uses in smaller quantities gold, palladium, copper and artificial stones such as nano-crystals and cubic zirconia. The decision to use only recycled gold and silver involves all the uses of these metals in Pandora jewelry, such as the use in grains, in semi-finished products such as necklaces and in other parts that come from third party suppliers.