There’s less people going to sell their jewelry. A sign that the global economy is getting better is precisely the decrease of gold from recycled jewelery, bars, coins and products industry, which dropped to 1,122 tons. According to the World Gold Council, the industry association of the leading gold mining, the volume has never been so low since 2007. Basically, the report published in collaboration with the Boston Consulting Group says that it has came back to pre-crisis levels . The reason? The turnover of the main source of precious metal second hand, that is jewelry, decreased because people no longer sells for cash. Analysts say that economic shocks may increase by 20% of the activities of so-called buy gold and similar, it happened during the Asian crisis in the late 1990s and there was a 25% increase during the last crisis in 2008 -2009. A lucrative trade that, however, now seems on the decline, at least in the US, with some sensational cases such as Cash4Gold.com. The site specialized in buy gold in 2009 had a turnover that could afford to pay $ 3 million for its commercials during the Super Bowl, but after just three years has failed. Perhaps the fault is not only due to a drastic drop in customers, but this company has declared bankruptcy and has changed hands. The devaluation of gold has had its relevance: the experts have shown a correlation between the decline in metal prices and and the activities of buy gold. For example, in 1999, when an ounce (a little more than 28 grams) of yellow metal was worth $ 250 provenance was distributed as follows: 73% mineral production and 17% recycling. Ten years after the value has exceeded for the first time the $ 1,000, the second rate has risen to 42%, a record since it stood at 26%. Of course, in countries like China and India which represent 60% of world demand is a sector yet to be developed, but in the West, things are changing. Federico Graglia

Stroili remains in Italy

Published on

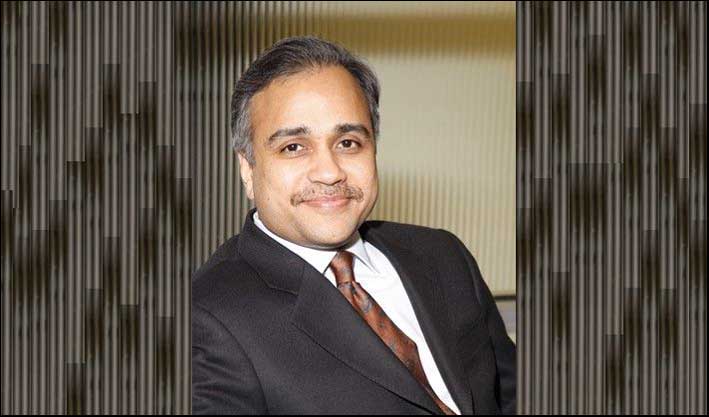

We change, we had joked: Stroili will not be sold to an Indian (https://gioiellis.com/stroili-venduta-indiano/). The newspaper Corriere della Sera, in an article by Carlo Turchetti, grinding the news published in November on the same pages. The owners of the brand of jewelry, the fund Investindustrial of Andrea Bonomi (which holds 31% indirectly), together with Intesa Sanpaolo (12%), 21 Investments (Benetton, with about 9%) and Wise Sgr ( about 9%), plus the Ergon fund, Francesco Micheli and De Nora family, have asked too much, or the bottom Emerisque direct from the Indian Ajay Khaitan, has rethought about it. Conclusion: Stroili remains Italian until further notice, and continues to be directed by ceo Maurizio Merenda. The purchase price of around 300 million, major of the revenues (230 million) may have discouraged investment. To purchase Stroili had also spoken of the Italian fund Clessidra by Claudio Sposito, which is headed for the activities related to luxury, to the former administrator of Bulgari, Francesco Trapani. Federico Graglia

Salma Hayek, wife of François Pinault, is now also a colleague of the French tycoon luxury group founder Kering: the actress is, in fact, the new face of Pomellato, an Italian jewelry company that was purchased by the Parisian empire just two years ago . Salma replaces the icy face of Tilda Swinton, who caused shivering (with cold) even in August. The job of the new ambassador, who has been shot voluptuously between the transparency of a pool in Los Angeles by Mert and Marcus, is also to warm the sales of the company famous also for rings Nudo, or for brand Dodo.

By the findings of the company’s financial records there is still a a long way to go. The last annual accounts available are those relating to 2013 (the 2014 budget has not yet been drafted). And just scroll down the columns for numbers to see how the situation of the company founded in 1965 by Pino Rabolini, conducted by Andrea Morante and chaired by Jean Marc Duplaix, needs a dash of good news. Nothing dramatic, mind you, but the crisis that envelops part of the jewelry world does not leaves out the company, which at the time that filed the accounts was split into two different entities: Pomellato SpA, the operating company, and the subsidiary Pomellato Europa.

The numbers speak for themselves: revenues in 2013 fell from 120.5 million euro to 117.7 million , a decrease by -2.37%. But worse was the gross operating margin (ie the one that determines the final result): the Ebitda, indeed, fell from 19.6 to 23.6 million, a decrease by almost 17%. A shrinking also for the cash flow, that is, the money cash: on 31 December 2013 Pinault has found 10.3 million euro, compared with 13.4 for the previous year. A situation that has brought profits down, fallen from 10.5 million to 6.7 million (-35.5%). On the other hand debts rose from 1,7 million to 2,5 million: in any case, a low figure compared to the level of income and the balance sheet of the company. Different situation for Pomellato Europa, which is a company of more small size. The subsidiary of its parent company, used for trading, closed with a loss of almost half a million euro compared to a profit of 413 thousand euro for the previous year, with revenues of 11.4 million. In short, gold jewelry, but numbers a bit less valuable. Federico Graglia

New ceo at Damiani group

Published on

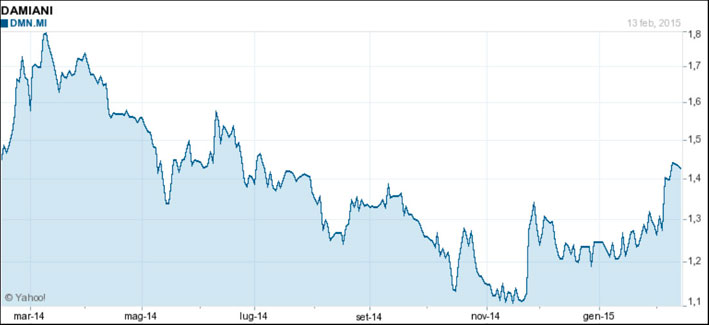

The Damiani Group is the only one luxury company listed on the Italian Stock Exchange. As such it is required to give account of his business every three months: an exercise uncomfortable, but that provides transparency to investors. Here, then, the accounts of the company from Piedmont in the first nine months of 2014-2015 (the budget closes every 31 March). Taking into account that in Italy the consumption is falling for all, the accounts are not too bad, in fact, show signs of recovery. In the accounts at December 31, 2014, revenues were up 5% at constant exchange rates, to 115.4 million euro. The good news is the growth in sales in the retail segment (+ 6.3%), and in particular the brand Damiani (58 direct sales outlets) is what pulls more, an increase of 22%. The retail channel, accounts for about 40% of the total turnover of the group. A little ‘in contrast with the rest of the market, Damiani also shows an increase in Italy by more than 5%, while overseas the revenue totaled an increase of 3.5% at constant rates, and 2.3% in current rates compared to the same period previous year, affected mainly by the devaluation of the yen. Positive gross margin (Ebitda) is of 5.2 million euro, with an improvement of 4.9 million euro compared to 31 December 2013. But the result remains a negative, albeit reduced: the nine months closed with eur -1.4 million, which still means an improvement of 61.6% compared to a year ago. No good news also from the negative net financial position of 50.2 million euro (40.8 million euro at March 31, 2014), but “as a result of seasonality and investments made during the period.”

But there is also a major innovation at the management of the group: the board of directors, “in view of the increasing direct involvement of President Guido Grassi Damiani in the process of internationalization of the Group, whose strategy is increasingly focused at a direct presence in foreign markets, has approved the appointment to the post of ceo of Damiani spa of vice president Giorgio Grassi Damiani, with control over operational management of Italian society. “Essentially Guido Grassi Damiani will continue to make the ambassador of the group around the world, while the reins operational industrial pass to his brother George. Federico Graglia

Ivana Ciabatti president of Federorafi

Published on

The goldsmiths have a new representative: is Ivana Ciabatti, entrepreneur in the district of Arezzo. She was elected president of Confindustria Federorafi, the national association representing more than 500 manufacturing companies of the goldsmith, silversmith and of Italian jewellery. She replaces Licia Mattioli, who finished his term. Ivana Ciabatti is sole director of Italpreziosi of Arezzo and since 1984 also CEO of Goldlake. He was president of the section goldsmiths and silversmiths within Confindustria Arezzo. F.G.

Diletta Rossi to Morellato

Published on

Diletta Rossi comes to Morellato, with the post of Global Head of Press and PR. In the past Diletta Rossi has held the position of Director of Communication in Alviero Martini 1st Class, Diesel and Pr Manager for Samsonite. The new pr will coordinate directly with Massimo Carraro, CEO and president of the Venetian group and to her will refer the activities and strategic projects related to the press office for the corporate brand Morellato, in addition to institutional pr globally. It will also be responsible for the definition and implementation of strategic activities related to social networks and Digital pr.Al his side will work team Marketing & Communication, led by Maria Luisa Padula. F.G.

A preview of the 2015 and a budget of work done so far: Florence Rollet is president of Tiffany & Co Europe. She was interviewed for L’Espresso by Roselina Salemi, former editor of the weekly A. We report the essential part.

The video for Christmas by Tiffany is simple. No actor. Only a short animated at fifty shades of blue. Location, a New York winter between Times Square, Tower Bridge, the ice rink, where couples and families carrying the Tiffany jewelry in macro version, only item not cartoon, from one part of the city. A magical world. Behind But there are people like Florence Rollet, President of Tiffany & Co. Europe, which give solidity to the fairy tale. Blonde, short hair, not very bejeweled (but the brooch that door is Schlumberger, one of the most famous designer of Tiffany) Florence Rollet is the first woman to hold such a position in the giant world of jewelry.

From beer to jewelry via the Dior perfumes. What is left of these experiences?

“It was a long way from the Kronenbourg brewery to today. I was in charge of the commercial and marketing. It was significant to me the year in Greece in 1990 to Henninger. I immediately loved this country, I learned the language. Going abroad is an experience that I recommend strongly to young people because it enriches, forces you to get back on topic, expands our vision to other ways of thinking. Teaches tolerance. I traveled a lot, I worked with people that I have been inspired.”

She is at the European summit of Tiffany. There is more space for women today, in the companies?

“The world has moved much on this issue in the last twenty years. Being a woman is not a defect or a quality, it is a fact! For some men a woman at the top can be a problem, but just react with professionalism and sense of humor, without being dramatic. I had the chance to be appreciated and supported. The most important thing is to adapt to the culture of the company. I was one of the first directors to Kronenbourg sales, and one of the first to have a general direction from Coty and I never had any problems. ”

What is your best quality?

“Two guidelines: to serve the customer and work in teams with colleagues.”

What added value brought new designers Francesca Amfitheatrof?

“A wave of energy. Has the same vision and creative passion that Charles Lewis Tiffany had 177 years ago, when it began our story. The Tiffany-T, designed by her, have been successful, but we are lucky: we have iconic collections that go beyond fashion and continue to enjoy anywhere in the world. Many celebrate the milestones of life with an object of value. Tiffany has high quality, hand fabrication and design that you can hand down in time. ”

What news do you have in the pipeline?

“There is not another Gatsby, but in 2015 we have many exciting initiatives, the creation of a documentary about Tiffany and opening a flagship store in Geneva.”

Morante and Rabolini, goodbye to Pomellato

Published on

Andrea Morante and Pino Rabolini, the souls of Pomellato, say goodbye. This was revealed in an article by Maria Silvia Sacchi, journalist for Corriere della Sera well informed (even) on the events in the world of fashion. Once you have joined Locman (https://gioiellis.com/anima-di-pomellato-entra-locman) the two have now acquired a 51% stake in Amf Snaps, an Italian company active in the field of design, production and marketing of accessories for luxury. Along with family Rabolini Ra.Mo holding, Andrea Morante (ceo of Pomellato), there is the family of Del Bon, of Bruni Glass. The operation was coordinated by Italglobal Partners, an investment holding company founded by Ruggero Jenna and Francesco Sala. The deal saw the acquisition of the stake held by the fund Cape Natixis Two and the company’s capitalization. The family Faerber, founder of the company, has increased its stake to 49%. The plan of the new shareholders, says Morante, is getting to about 30 million in revenue over five years, compared to about 18 million which is expected to close in 2014. “Within three years we want to enter in the stock exchange,” said Morante. Amf is based in Bassano del Grappa (Vicenza). Carmen Toffanello was confirmed ceo. Here is the article published by Corriere.

Throughout the 2015 Andrea Morante will have a thought before any other: Pomellato, the group of jewelery of which (since 2009) is ceo. In late 2015, however, the manager will hand the company to the Kering men, the French company that has bought control in 2013 by the same Morante and its founder Pino Rabolini. At least a bit of money collected with that task is returning to Italy. Morante and Rabolini, in fact, in a few days announced they have detected 51% (with the family Del Bon) of Amf Snaps, company design, manufacture and marketing of accessories for the luxury. And of the 11.5% in the company of Marco Mantoiani, Locman watches. “For a full year for me the priority is Pomellato – says Morante -. But I believe it is the time to seize the opportunity and give support to initiatives that need more ideas, internationality and positivity, and not a financial support. Locman is one of the few Italian brands of watches remained, has its own history and its own school and success in Italy, have to be good to go well here… As for Amf is active in that segment of the metallic objects for the luxury in which Italy is excellence”.

And virtuous, though still at the level of start-up, is Stecco Nature, Sicilian ice cream that Morante has found alone, but where will be joined by Rabolini. The food is an “old friend” of Morante, manager-entrepreneur with a past as a man of the City, who had been interested in Peck before it passed to Peter Marzotto. “The food that combines the well-being and the quality will be the new frontier,” he says. Who knows if it will be there the next investment of Morante-Rabolini. M.S.S.

L’anima di Pomellato entra in Locman

Published on

Un pizzico di Pomellato negli orologi Locman. L’azienda italiana di segnatempo vede l’ingresso tra i soci di Giuseppe Rabolini e Andrea Morante, rispettivamente fondatore e amministratore delegato di Pomellato. Rabolini e Morante acquisiscono l’11,5% della società di orologeria con sede all’Isola d’Elba. D’altra parte le due aziende si conoscono bene. L’attuale collezione di orologi Dodo (brand del gruppo Pomellato), per esempio, è stata prodotta proprio da Locman. L’impresa toscana, fondata nel 1986 dall’attuale presidente e socio di maggioranza, Marco Mantovani, che la guida assieme a Peppino Pea, vende in tutto il mondo attraverso negozi monomarca e concessionari ufficiali. «Da oggi nella compagine sociale, insieme a me e Peppino Pea, mio socio storico, ci saranno due amici che stimo moltissimo e che condivideranno strategie e obiettivi, assicurando all’azienda maggior forza e stabilità. Si tratta di uomini di grande esperienza industriale che ci aiuteranno certamente nel percorso di crescita in un mercato mondiale sempre più attento e selettivo», ha commentato Mantovani.

Locman punta a sviluppare una rete di negozi monomarca, soprattutto all’estero, e a una politica di espansione basata sulla presenza diretta nei principali mercati attraverso strutture di proprietà. In questo percorso sarà valutata a medio termine anche la possibilità di una quotazione in Borsa. Federico Graglia

Abbati lascia Fossil per Nardelli

Published on

Una novità di rilievo nel mondo della gioielleria e del watchmaking: Stefano Abbati, 53 anni, lascia Fossil, di cui era managing director, ed entra nell’azionariato di Nardelli Luxury. L’azienda fondata da Bruno Nardelli ha lanciato il brand di orologi e gioielli Liu Jo Luxury, nato dalla partnership con il brand del fashion Liu Jo.

Abbati ha alle spalle una carriera iniziata in aziende del mass market, come Granarolo e Ferrero. È poi passato in Sector Group e successivamente in Binda Group e Fossil. Abbati affiancherà Nardelli come vice president nella strategia di internazionalizzazione di Liu Jo Luxury e nello sviluppo della licenza a livello globale rafforzando la squadra che vede Salvatore Francavilla direttore generale e Paolo Innocenti direttore vendite.

«L’entrata in squadra di Stefano Abbati rappresenta un tassello importante nella strategia di consolidamento dell’azienda. Un’azienda che diventa sempre più azienda istituzione grazie alla presenza di manager e oggi all’ingresso di Stefano nell’azionariato. Abbati è un punto di riferimento riconosciuto nel settore dell’orologeria ed è uno dei maggiori conoscitori del mercato delle licenze», è il commento di Nardelli. «Dopo dieci anni in una multinazionale ho sentito il bisogno di cogliere nuove sfide personali e professionali puntando su una realtà unica nel panorama dell’orologeria fashion italiana. Liu Jo Luxury nel mondo della distribuzione del nostro settore è il marchio fashion italiano che più rappresenta la creatività, l’originalità, la fantasia proprie dell’Italian Design. Questa esperienza è maggiormente stimolante perché sento mio il progetto di operare in una realtà imprenditoriale vivace ed in continua crescita», ha aggiunto Abbati. Federico Graglia

![]() Abbati leaves Fossil to Nardelli

Abbati leaves Fossil to Nardelli

An important news in the world of jewelery and watchmaking: Stefano Abbati, 53, leaves Fossil, of which he was managing director, and takes a stake in Nardelli Luxury. The company founded by Bruno Nardelli launched the brand of watches and jewelry Liu Jo Luxury, born from the partnership with the fashion brand Liu Jo.

Abbati started a career in companies of mass market, as Granarolo and Ferrero. He then moved in Sector Group and subsequently in Binda Group and Fossil. Abbati will alongside Nardelli as vice president in the internationalization strategy of Liu Jo Luxury and development license globally by strengthening the team that sees Salvatore Francavilla general manager and sales manager Paolo Innocenti.

“The entry into the team of Stefano Abbati is an important element in the strategy of consolidation of the company. A company that becomes increasingly firm establishment thanks to the manager and today at the entrance of Stephen shareholders. Abbati is a recognized landmark in the watch industry and is one of the most knowledgeable of the licensing market,” is the comment of Nardelli. “After ten years in a multinational company, I felt the need to pursue new personal and professional challenges by focusing on a really unique in the Italian fashion watchmaking. Liu Jo Luxury in distribution of our industry is the Italian fashion brand that best represents creativity, originality, imagination own Italian Design. This experience is more challenging because I feel my project to operate in a business enterprise vibrant and growing,” he added Abbati.

![]() Abbati laisse Fossil pour Nardelli

Abbati laisse Fossil pour Nardelli

Une nouvelle importante dans le monde de la bijouterie et de l’horlogerie: Stefano Abbati, 53, laisse Fossil, dont il a été directeur général, et prend une participation dans Nardelli luxe. La société fondée par Bruno Nardelli a lancé la marque de montres et de bijoux Liu Jo Luxe, née de la collaboration avec la marque de mode Liu Jo.

Abbati a commencé une carrière dans des entreprises de marché de masse, comme Granarolo et Ferrero. Il a ensuite déménagé dans le groupe du secteur et par la suite dans Binda Groupe et Fossil. Abbati sera aux côtés Nardelli comme vice-président de la stratégie d’internationalisation de Liu Jo luxe et le développement à l’échelle mondiale par le renforcement de la licence de l’équipe qui voit Salvatore Francavilla directeur général et directeur des ventes Paolo Innocenti.

“L’entrée dans l’équipe de Stefano Abbati est un élément important dans la stratégie de consolidation de la société. Une société qui devient de plus en plus fermes établissement grâce à la gestionnaire et aujourd’hui à l’entrée des actionnaires Stephen. Abbati est un point de repère reconnu dans la montre l’industrie et est l’un des plus compétents du marché des licences”, est le commentaire de Nardelli. “Après dix ans dans une multinationale, je ai senti la nécessité de poursuivre de nouveaux défis personnels et professionnels en mettant l’accent sur un fait unique dans l’horlogerie de la mode italienne. Liu Jo luxe dans la distribution de notre industrie est la marque de mode italienne qui représente le mieux la créativité, l’originalité, l’imagination propre design italien. Cette expérience est plus difficile parce que je sens mon projet pour fonctionner dans une entreprise dynamique et en croissance”, at-il ajouté Abbati.

![]() Abbati verlässt Fossil zu Nardelli

Abbati verlässt Fossil zu Nardelli

Eine wichtige Neuigkeiten in der Welt der Schmuck- und Uhren: Stefano Abbati, 53, verlässt Fossil, von denen er Geschäftsführer wurde, und beteiligt sich an der Nardelli Luxus. Das Unternehmen von Bruno Nardelli gegründet startete die Marke von Uhren und Schmuck Liu Jo Luxus, von der Partnerschaft mit der Modemarke Liu Jo geboren.

Abbati begann eine Karriere in Unternehmen der Massenmarkt, wie Granarolo und Ferrero. Danach wechselte er in Sector Group und anschließend in Binda Group und Fossil. Abbati wird neben Nardelli als Vice President in der Internationalisierungsstrategie von Liu Jo Luxus und Entwicklungslizenz global durch die Stärkung der Mannschaft, die Salvatore Franca Geschäftsführer und Vertriebsleiter Paolo Innocenti sieht.

“Der Eintritt in das Team von Stefano Abbati ist ein wichtiges Element in der Strategie der Konsolidierung des Unternehmens. Ein Unternehmen, das immer Verankerung dank der Manager und heute am Eingang der Stephen Aktionäre wird. Abbati ist eine Sehenswürdigkeit in der Uhren Industrie und ist einer der besten Kenner der Lizenzmarkt”, ist der Kommentar von Nardelli. “Nach zehn Jahren in einem multinationalen Unternehmen, fühlte ich die Notwendigkeit, neue persönliche und berufliche Herausforderungen, die sich auf eine wirklich einzigartig in der italienischen Modeuhrenindustrie zu verfolgen. Liu Jo Luxus im Vertrieb unserer Branche ist die italienische Modemarke, die am besten steht für Kreativität, Originalität, Phantasie eigenen Italian Design. Diese Erfahrung ist eine größere Herausforderung, weil ich das Gefühl, mein Projekt in einem Unternehmen lebhafte und wachsende betreiben”, fügte er hinzu Abbati.

![]() Abbati оставляет Fossil, чтобы Нарделли

Abbati оставляет Fossil, чтобы Нарделли

Важные новости в мире ювелирные и часовые: Стефано Abbati, 53, оставляет Fossil, из которых он был управляющим директором и принимает долю в Nardelli Luxury.Компания, основанная Бруно Нарделли запустил бренд часы и ювелирные изделия Liu Jo роскоши, родился от партнерства с модного бренда Liu Jo.

Abbati начал карьеру в компании, массового рынка, так как Гранароло и Ферреро. Затем он переехал в группы сектора, а затем в Binda группы и ископаемых. Abbati будет рядом Нарделли в качестве вице-президента в стратегии интернационализации Liu Jo Luxury и развития лицензии на глобальном уровне за счет укрепления команды, которая видит Сальваторе Франкавилла генеральный менеджер и менеджер по продажам Паоло Innocenti.

“Вступление в команды Стефано Abbati является важным элементом в стратегии консолидации компании. Компания, которая становится все более и более прочного утверждения спасибо менеджеру, и сегодня на въезде акционеров Стивен. Abbati является признанным ориентиром в часах промышленности и является одним из наиболее знающих рынка лицензирования “, является комментарий Нарделли. “После десяти лет в международной компании, я почувствовал необходимость проводить новые личные и профессиональные проблемы, сосредоточив внимание на действительно уникальным в итальянском моды часов. Liu Jo Luxury в распределении нашей индустрии итальянский модный бренд, который лучше всего представляет творчество, оригинальность, воображение собственной итальянского дизайна. Этот опыт является более сложным, потому что я чувствую свой проект для работы в бизнес-предприятия динамичного и растущего, “добавил он Abbati.

Una noticia importante en el mundo de la joyería y la relojería: Stefano Abbati, de 53 años, deja Fossil, de la que fue director, y toma una participación en Nardelli lujo. La compañía fundada por Bruno Nardelli lanzó la marca de relojes y joyas Liu Jo Lujo, nacido de la colaboración con la marca de moda Liu Jo.

Abbati comenzó una carrera en empresas del mercado de masas, como Granarolo y Ferrero. Luego se trasladó en el Grupo Sectorial y posteriormente en Binda Group y Fossil. Abbati hará junto Nardelli como vicepresidente en la estrategia de internacionalización de Liu Jo lujo y de desarrollo de licencias a nivel mundial mediante el fortalecimiento del equipo que ve Salvatore Francavilla gerente general y gerente de ventas Paolo Innocenti.

“La entrada en el equipo de Stefano Abbati es un elemento importante en la estrategia de consolidación de la empresa. Una empresa que se convierte cada vez más firme establecimiento gracias a la gerente y hoy en la entrada de accionistas Stephen. Abbati es un hito reconocido en el reloj industria y es uno de los más conocedores del mercado de licencias”, es el comentario de Nardelli. “Después de diez años en una empresa multinacional, sentí la necesidad de buscar nuevos retos personales y profesionales, centrándose en una realidad única en la relojería de moda italiana. Liu Jo Lujo en la distribución de nuestra industria es la marca de moda italiana que mejor representa la creatividad, la originalidad, la imaginación propia de diseño italiano. Esta experiencia es más difícil porque siento mi proyecto para operar en una empresa dinámica y en crecimiento”, agregó Abbati.

Sofisti lascia i gioielli di Gucci

Published on

Michele Sofisti ha lasciato la carica di Ceo di Gucci (gruppo Kering) per orologi e gioielli. In un comunicato, la società ha spiegato che Sofisti, in carica dal 2009, ha lasciato la posizione per «perseguire altre opportunità personali e professionali». La decisione ha sorpreso molti. «Michele è stato la mente del turnaround di Gucci e ha programmato l’espansione nel settore orologi», ha commentato Patrizio di Marco, presidente e Ceo di Gucci. «L’intero merito di successo GGWJ appartiene solo a lui e della grande squadra che ha costruito. Michele è un grande dirigente che ha amato questo marchio e che è riuscito dove chiunque altro avrebbe fallito. Lui è una grande persona con un grande cuore che ho l’onore di chiamare il mio amico». «Gli ultimi sei anni hanno portato grandi soddisfazioni, abbiamo cominciato a far emergere il potenziale di queste due categorie per il marchio Gucci», ha detto Sofisti. «C’è un team di gestione eccezionale che garantirà di continuare il lavoro». Il successore di Sofisti non è ancora stato annunciato. F.G.

![]() Sofisti leaves the jewels of Gucci

Sofisti leaves the jewels of Gucci

Michele Sofisti has left his position as Ceo of Gucci (group Kering) for watches and jewelry. In a statement, the company explained that Sofisti, in office since 2009, has left the position to “pursue other personal and professional opportunities.” The decision surprised many. “Michele was the mastermind of the turnaround of Gucci and has planned expansion in watches,” said Patrizio di Marco, president and Ceo of Gucci. “The whole merit of success GGWJ belongs only to him and the great team he has built. Michele is a great leader who loved this brand and that has succeeded where everyone else would have failed. He is a great person with a big heart I have the honor to call my friend”. “The last six years have brought great satisfaction, we started to bring out the potential of these two categories for the Gucci brand,” said Sofisti. “There’s an outstanding management team that will ensure to continue the work.” The successor of Sofisti has not yet been announced.

![]() Sofisti laisse les bijoux de Gucci

Sofisti laisse les bijoux de Gucci

Michele Sofisti a quitté son poste de directeur général de Gucci (groupe Kering) pour les montres et bijoux. Dans un communiqué, la compagnie a expliqué que Sofisti, en poste depuis 2009, a quitté son poste à “poursuivre d’autres opportunités personnelles et professionnelles.” La décision a surpris plusieurs. “Michele était le cerveau du redressement de Gucci et a prévu l’expansion dans les montres”, a déclaré Patrizio di Marco, Président et Ceo de Gucci. “Le tout le mérite du succès GGWJ ne appartient qu’à lui et la grande équipe qu’il a construit. Michele est un grand leader qui aimait cette marque et que a réussi là où tout le monde aurait échoué. Il est une grande personne avec un grand cœur, je ai l’honneur d’appeler mon ami”. “Les six dernières années ont apporté une grande satisfaction, nous avons commencé à faire ressortir le potentiel de ces deux catégories pour la marque Gucci”, a déclaré Sofisti. “Il y a une équipe de gestion exceptionnelle qui assurera de poursuivre le travail”. Le successeur de Sofisti n’a pas encore été annoncé.

![]() Sofisti verlässt den Schmuck von Gucci

Sofisti verlässt den Schmuck von Gucci

Michele Sofisti hat sein Amt als Vorstandsvorsitzender der Gucci (Gruppe Kering) für Uhren und Schmuck verlassen. In einer Stellungnahme erklärte das Unternehmen, dass Sofisti, im Amt seit 2009 hat sich die Lage nach links “anderen persönlichen und beruflichen Herausforderungen zu stellen.” Die Entscheidung hat viele überrascht. “Michele war der führende Kopf der Turnaround von Gucci und die Expansion im Uhren geplant”, sagte Patrizio di Marco, Präsident und Ceo von Gucci. “Die ganze Verdienst Erfolg GGWJ gehört nur ihm und dem großen Team, das er gebaut hat. Michele ist ein großer Führer, die diese Marke geliebt und dass ist es gelungen, in der jeder andere wäre gescheitert. Er ist ein großartiger Mensch mit einem großen Herzen Ich habe die Ehre, mein Freund “nennen. “Die letzten sechs Jahren haben große Befriedigung gebracht haben wir begonnen, das Potenzial für die Marke Gucci diesen beiden Kategorien zu bringen”, sagte Sofisti. “Es gibt ein hervorragendes Management-Team, das sicherstellt, um die Arbeit fortzusetzen.” Der Nachfolger des Sofisti hat noch nicht bekannt gegeben.

![]() Sofisti оставляет драгоценности Gucci

Sofisti оставляет драгоценности Gucci

Мишель Sofisti оставил свой пост генерального директора Gucci (группа Kering) для часов и ювелирных изделий. В заявлении, компания объяснила, что Sofisti, в офисе с 2009 года, покинул пост, чтобы “преследовать другие личные и профессиональные возможности.”Решение удивил многих. “Микеле вдохновителем оборачиваемости Gucci и планируется расширение часов”, сказал Патрицио ди Марко, президент и главный исполнительный директор Gucci. “Вся заслуга успеха GGWJ принадлежит только ему и великой команды он построен. Michele является великий лидер, который любил эту марку, и что удалось, где все остальные потерпели бы неудачу. Он великий человек с большим сердцем у менячесть называть моего друга “. “За последние шесть лет принесли большое удовлетворение, мы начали вывести потенциал этих двух категорий для бренда Gucci,” сказал Sofisti. “Там выдающаяся команда управления, которая обеспечит, чтобы продолжить работу.”Преемник Sofisti еще не было объявлено.

![]() Sofisti deja las joyas de Gucci

Sofisti deja las joyas de Gucci

Michele Sofisti ha dejado su cargo de Ceo de Gucci (grupo Kering) para relojes y joyas. En un comunicado, la compañía explicó que Sofisti, en el poder desde 2009, ha dejado a la posición de “perseguir otras oportunidades personales y profesionales”. La decisión sorprendió a muchos. “Michele fue el cerebro de la vuelta de Gucci y ha planificado la expansión en los relojes”, dijo Patrizio di Marco, presidente y consejero delegado de Gucci. “Todo el mérito del éxito GGWJ pertenece sólo a él y al gran equipo que ha construido. Michele es un gran líder que amaba a esta marca y que ha tenido éxito donde todos los demás habría fracasado. Él es una gran persona con un gran corazón que tengo el honor de llamar a mi amigo “. “Los últimos seis años han traído gran satisfacción, empezamos a poner de manifiesto el potencial de estas dos categorías para la marca Gucci”, dijo Sofisti. “Hay un excelente equipo de gestión que asegure para continuar el trabajo.” El sucesor de Sofisti aún no ha sido anunciado.

Per Damiani semestre in bianco e nero

Published on

Nel primo semestre dell’anno fiscale 2014/2015 Damiani rivede l’utile lordo. Una nota della società sottolinea «un trend positivo che si protrae ormai da cinque esercizi che testimonia l’apprezzamento sempre crescente del brand da parte del consumatore finale». I ricavi dal canale retail hanno raggiunto il 44,1% dei ricavi da vendite, in ulteriore crescita rispetto al primo semestre dell’esercizio precedente.

Nel corso del primo semestre (che va da marzo a settembre, dato che il bilancio di Damiani si chiude al 31 marzo) l’azienda piemontese, che ha celebrato quest’anno i 90 anni di attività, ha però registrato vendite per 62,1 milioni di euro, rispetto ai 65,0 milioni di euro registrati nell’analogo periodo dell’esercizio precedente, con una variazione negativa del -3,8% a tassi di cambio costanti e del -4,5%, a tassi di cambio correnti. In compenso, l’Ebitda (utile lordo) consolidato è positivo per 100mila euro. Poco, ma sempre meglio del dato negativo di –3 milioni al 30 settembre 2013. Miglioramento merito, continua la nota, «di azioni di riorganizzazione interna». Premesso questo, il risultato operativo consolidato resta negativo, anche se in miglioramento: –2,2 milioni di euro, rispetto ai –4,6 milioni dello scorso anno. In definitiva, nei primi sei mesi il gruppo ha chiuso «con un risultato netto consolidato di competenza negativo e pari a -3,4 milioni di euro rispetto ai -6,1 milioni di euro conseguiti il 30 settembre 2013». Anche i debiti sono cresciuti: la posizione finanziaria è negativa per 47 milioni di euro, rispetto ai 40,8 milioni registrati al 31 marzo scorso. Ma l’azienda fa sapere che «la variazione è principalmente riconducibile alle dinamiche stagionali dei flussi finanziari».

Da registrare anche che nei sei mesi passati Damiani è uscita dal segmento Star di Borsa Italiana. Uno dei motivi è anche la «la riduzione del flottante (cioè delle azioni trattate in Borsa ndr) al di sotto della soglia del 20% del capitale, minimo richiesto per la presenza nel segmento Star e dall’obiettivo di focalizzare la struttura del gruppo sul core business». Damiani resta ancora quotata a Piazza Affari ma le azioni liberamente scambiate si assottigliano. A questo si aggiungono volumi particolarmente elevati negli ultimi giorni. Qualcuno si potrebbe chiedere se, per caso, l’intenzione sia quella di un prossimo addio al listino.

Sempre nel semestre concluso a settembre, l’azienda ha proceduto con la fusione per incorporazione tra Damiani S.p.A. e Rocca S.p.A., «operazione è finalizzata ad assicurare una maggiore funzionalità del Gruppo, sotto il profilo economico e finanziario, e si inserisce nell’ambito delle azioni di riorganizzazione già in gran parte realizzate nei precedenti esercizi».

Damiani, in ogni caso, è molto attiva sul piano del rilancio. Lo scorso ottobre, insieme all’ex calciatore giapponese Hidetoshi Nakata, ha lanciato la nuova collezione Metropolitan Dream by H. Nakata con l’obiettivo di reperire risorse per sostenere il progetto Home for all, lanciato nel 2011 e diretto dall’architetto Toyo Ito, per aiutare le vittime del terremoto che ha colpito il Giappone nel marzo 2011 nella ricostruzione delle città colpite e di migliorare la vita quotidiana della comunità.

Semester in improvement for Damiani

In the first half of fiscal year 2014/2015 Damiani revises the gross profit. A note of the company emphasizes “a positive trend that has lasted for five years testifies to the growing appreciation of the brand by the end consumer.” Revenues from retail channel reached 44.1% of revenues from sales, a further increase over the first half of the previous year.

During the first six months (from March to September, because the financial statements of Damiani closes March 31) the Piedmont company, which this year celebrated 90 years in business, has posted sales of 62.1 million euro, compared to 65.0 million euro in the same period of the previous year, a decrease of -3.8% at constant exchange rates and -4.5% at current exchange rates . On the other hand, Ebitda (gross profit) consolidated is positive for 100 thousand euro. Little, but still better than the negative figure of -3 million at September 30, 2013. The Improvement, a note continues, is the result “of internal reorganization.” That said, the consolidated operating profit remains negative, although improving: -2.2 million euro, compared to 4.6 million last year. Ultimately, in the first six months, the group closed with a consolidated net profit attributable negative and amounted to -3.4 million compared to EUR -6.1 million euro achieved September 30, 2013. Even the debts have grown: the financial position was negative for 47 million euro, compared to 40.8 million recorded at 31 March. But the company says that “the change was mainly due to the seasonal dynamics of financial flows.”

Moreover, in the past six months Damiani left the Star segment of the Italian Stock Exchange. One of the reasons is also the “reduction of the free float (shares traded on the Stock Exchange ndr) below the threshold of 20% of the capital, the minimum required for the presence in the Star segment. The focus is on the structure of the group core business. Damiani is still listed on the stock exchange but the shares freely traded dwindle. Added to this are particularly high volumes in recent days. Someone might wonder if, by chance, the intention is the delisting.

Also in the first half ended in September, the company proceeded with the merger between Damiani SpA and Rocca SpA, “operation aims to ensure greater functionality of the Group, from the economic and financial environment, and is part of the reorganization already largely made in previous years.”

Damiani, in any case, is very active in terms of the relaunch. Last October, together with former Japanese footballer Hidetoshi Nakata, has launched the new collection Metropolitan Dream by H. Nakata with the aim of raising funds to support the project Home for All, launched in 2011 and directed by the architect Toyo Ito, to help victims of the earthquake that hit Japan in March 2011 in the reconstruction of the affected cities and to improve the daily life of the community.

Fossil sposa di nuovo Michael Kors

Published on

Fossil Group ha rinnovato dell’accordo di licenza globale con Michael Kors Holdings Limited per altri dieci anni: produrrà i gioielli firmati dallo stilista americano fino al 2024. Il marchio Michael Kors, noto per gli abiti e gli accessori di lusso, ha lavorato con Fossil dal 2004. Il risultato sono una linea di orologi fashion-forward che sono progettati, sviluppati e distribuiti dal Gruppo Fossil e, dal 2010, anche alcune collezioni di gioielli (https://gioiellis.com/michael-kors-incatentato, https://gioiellis.com/i-lucchetti-michael-kors), che con il rinnovo della licenza, quindi, si potranno continuare ad acquistare anche in Italia. Ora l’alleanza tra le due aziende si stringe: che cosa ne nascerà? Federico Graglia

![]() Fossil another 10 years with Kors

Fossil another 10 years with Kors

Fossil Group has renewed the global license agreement with Michael Kors Holdings Limited for a further ten years: will produce the jewels signed by the American designer until 2024. With the brand Michael Kors, known for clothing and luxury accessories, Fossil has worked since 2004. The result is a line of fashion-forward watches that are designed, developed and distributed by the Fossil Group and, from 2010, also some collections of jewelry (https://gioiellis.com/michael-kors-incatentato, https://gioiellis.com/i-lucchetti-michael-kors). Now the alliance between the two companies is doubled: what will be born?

Le Groupe Fossil a renouvelé le contrat de licence mondial avec Michael Kors Holdings Limited pendant autre dix ans: va produire les bijoux signés par le designer américain jusqu’en 2024. Avec la marque Michael Kors, connue pour les vêtements et accessoires de luxe, Fossil a travaillé depuis 2004. Le résultat est une ligne de montres avant-gardistes qui sont conçus, développés et distribués par le Groupe Fossil et, à partir de 2010, aussi des collections de bijoux (https://gioiellis.com/michael-kors-incatentato, https://gioiellis.com/i-lucchetti-michael-kors). Maintenant, l’alliance entre les deux sociétés est doublé: ce sera né?

![]() Fossil weitere 10 Jahre mit Kors

Fossil weitere 10 Jahre mit Kors

Fossil Group hat den weltweiten Lizenzvereinbarung mit Michael Kors Holdings Limited für weitere zehn Jahre verlängert: wird die vom amerikanischen Designer bis 2024 unterzeichnet Mit der Marke Michael Kors, für Kleidung und Luxus-Accessoires bekannt Juwelen herzustellen, hat Fossil seit 2004 arbeitete. Das Ergebnis ist eine Reihe von fashion-forward-Uhren, die von der Fossil-Gruppe entwickelt werden, entwickelt und vertrieben und ab 2010 auch einige Sammlungen von Schmuck (https://gioiellis.com/michael-kors-incatentato, https://gioiellis.com/i-lucchetti-michael-kors). Nun ist die Allianz zwischen den beiden Unternehmen wird verdoppelt: was wird geboren werden?

Ископаемые Группа возобновила глобальное лицензионное соглашение с Michael Kors Holdings Limited в течение последующих десяти лет: будет производить драгоценности не подписанные американским дизайнером до 2024 года с маркой Michael Kors, известный одежды и аксессуаров класса люкс, Fossil работал с 2004 года. Pезультатом является линия модных вперед часы, которые предназначены, разработанных и распространяемых ископаемых группе, а с 2010 года, а также некоторые коллекции ювелирных изделий (https://gioiellis.com/michael-kors-incatentato, https://gioiellis.com/i-lucchetti-michael-kors). Теперь альянс между двумя компаниями в два раза: что родится?

![]() Fósiles otros 10 años con Kors

Fósiles otros 10 años con Kors

Fossil Grupo ha renovado el acuerdo de licencia mundial con Michael Kors Holdings Limited para otros diez años: se producen las joyas firmadas por el diseñador americano hasta 2024. Con la marca Michael Kors, conocido por accesorios de vestir y de lujo, Fossil ha trabajado desde el año 2004. El resultado es una línea de relojes de la moda hacia adelante que se han diseñado, desarrollado y distribuido por el Grupo de fósiles y, a partir de 2010, también algunas colecciones de joyas (https://gioiellis.com/michael-kors-incatentato, https://gioiellis.com/i-lucchetti-michael-kors). Ahora, la alianza entre las dos empresas se duplicó: lo que va a nacer?

Pandora, affari d’oro con l’argento

Published on

I gioielli di Pandora si vendono sempre di più. La crescita è legata a un incremento delle vendite delle nuove collezioni, ai continui riordini e all’apertura di nuovi monomarca. Tanto che l’azienda prevede di migliorare gli affari rispetto alle previsioni, dopo aver annunciato ottimi risultati nel terzo trimestre (crescita del fatturato del 24,6% a circa 382,7 milioni di euro). L’Ebitda (cioè il margine operativo lordo) è salito del 33,8% a circa 137,2 milioni di euro, mentre l’utile netto è di 97,4 milioni. Per il 2014 Pandora prevede un fatturato di 1,54 miliardi di euro e un Ebitda oltre il 35%. Gli affari migliori Pandora li ottiene nell’area Asia Pacifico, con un balzo del 40,5%, Europa (+27,4%) e America (+17,8%). Per il 2014 sono previste 300 nuove aperture (rispetto alla precedente aspettativa di 275).

Ovviamente contento il ceo, Allan Leighton: «Siamo soddisfatti di aver archiviato un altro trimestre con un’importante performance, riportando il nostro più alto fatturato ed Ebitda, mai registrato fino a oggi e tutte le regioni hanno continuato a funzionare bene, grazie all’espansione della rete di negozi, e alle nuove linee di prodotti», ha commentato. Federico Graglia

![]() Pandora silver jewelry are sold like gold

Pandora silver jewelry are sold like gold

The Pandora jewelry are sold more and more. The increase was due to increased sales of the new collections, the continuous re-orders and the opening of new flagship stores. So much so that the company plans to improve the business expected, after it announced good results for the third quarter (revenue growth of 24.6% to approximately 382.7 million euro). The Ebitda rose by 33.8% to approximately eur 137.2 million, while net profit is 97.4 million. For 2014, Pandora expects revenue of eur 1.54 billion and Ebitda of over 35%. Pandora gets the best deals in the Asia Pacific region, with a jump of 40.5%, Europe (+ 27.4%) and America (+ 17.8%). For 2014, 300 new openings of stores are planned (compared to the previous expectation of 275).

Obviously pleased with the ceo, Allan Leighton, “We are pleased to have closed another quarter with significant performance, reporting our highest revenue and Ebitda, ever recorded so far and all regions have continued to perform well, thanks to expansion of the store network, and new product lines,” he said.

![]() Les bijoux en argent Pandora sont vendus comme or

Les bijoux en argent Pandora sont vendus comme or

Les bijoux Pandora sont vendus de plus en plus. L’augmentation est attribuable à les ventes des nouvelles collections, les re-commandes continues et l’ouverture de nouveaux magasins. Tant et si bien que la société prévoit d’améliorer l’entreprise devrait, après avoir annoncé de bons résultats pour le troisième trimestre (croissance du chiffre d’affaires de 24,6% à environ € 382 700 000). Le Baila a augmenté de 33,8% à environ 137,2 millions d’euros, tandis que le bénéfice net est 97,4 M. Pour 2014, Pandora prévoit des revenus de 1,54 milliards d’euros et un Baila de plus de 35%. Pandora obtient les meilleures offres dans la région Asie-Pacifique, avec un bond de 40,5%, l’Europe (+ 27,4%) et en Amérique (+ 17,8%). Pour 2014, 300 nouvelles ouvertures de magasins sont prévues (par rapport à la précédente prévision de 275).

De toute évidence heureux avec le directeur général, Allan Leighton, «Nous sommes heureux d’avoir conclu un autre trimestre avec une performance significative, notre rapport sur le revenu le plus élevé et le Baila, jamais enregistré à ce jour et toutes les régions ont continué de bien performer, grâce à l’expansion du réseau de magasins , et de nouvelles lignes de produits», at-il dit.

![]() Pandora Silberschmuck, sind wie Gold verkauft

Pandora Silberschmuck, sind wie Gold verkauft

Die Pandora Schmuck sind mehr und mehr verkauft. Der Anstieg ist auf erhöhte Umsätze der neuen Kollektionen, die kontinuierlichen Nachbestellungen und die Eröffnung neuer Flagship-Stores. So sehr, dass das Unternehmen plant, verbessern das Geschäft erwartet, nachdem es bekannt gegeben gute Ergebnisse für das dritte Quartal (Umsatzwachstum von 24,6% auf rund 382.700.000 €). Das Ebitda stieg um 33,8% auf rund eur 137,2 Mio, während der Nettogewinn beträgt 97,4 Mio euro. Für 2014 erwartet Pandora einen Umsatz von eur 1,54 Mrd. und ein Ebitda von über 35%. Pandora bekommt die besten Angebote in der Region Asien-Pazifik, mit einem Sprung von 40,5%, Europa (+ 27,4%) und Amerika (+ 17,8%). Für 2014 300 Neueröffnungen von Läden sind geplant (im Vergleich zum vorherigen Erwartung von 275).

Offensichtlich zufrieden mit dem Ceo, Allan Leighton, “Wir freuen uns, ein weiteres Quartal mit signifikanten Performance geschlossen haben, berichten unsere höchste Umsatz und Ebitda, jemals so weit erfasst und alle Regionen weiterhin eine gute Leistung, dank Ausbau des Filialnetzes und neue Produktlinien”, sagte er.

![]() Pandora ювелирных изделий из серебра, продаются, как золото

Pandora ювелирных изделий из серебра, продаются, как золото

Pandora ювелирных изделий продаются больше и больше. Увеличение произошло за счет увеличения продаж новых коллекций, непрерывных повторных заказов и открытием новых флагманских магазинов. Настолько, что компания планирует улучшить бизнес и ожидалось, после того, как объявил хорошие результаты за третий квартал (рост выручки на 24,6% до примерно 382 700 000 евро). Показатель Ebitda вырос на 33,8% до примерно 137 200 000 евро, в то время как чистая прибыль 97,4 млн долларов. Для 2014 года, Pandora ожидает выручку в размере миллиарда евро 1,54 и Ebitda свыше 35%. Pandora получает лучшие предложения в Азиатско-Тихоокеанском регионе, со скачком на 40,5%, Европы (+ 27,4%) и Америки (+ 17,8%). Для 2014 года, 300 новых открытий магазинов планируется (по сравнению с предыдущим ожидании 275).

Очевидно доволен генеральный директор, Аллан Лейтон: “Мы рады, что закрыли еще четверть со значительным производительности, отчетности нашу самую высокую выручку и Ebitda, когда-либо зарегистрированных до сих пор и все регионы продолжают выполнять хорошо, благодаря расширению сети магазинов, и новые производственные линии,” сказал он.

![]() La Joyería de plata de Pandora se venden como el oro

La Joyería de plata de Pandora se venden como el oro

La joyería de Pandora se venden cada vez más. El incremento se debió al aumento de las ventas de las nuevas colecciones, las re-órdenes continuas y la apertura de nuevas tiendas de la marca. Tanto es así que la compañía planea mejorar el negocio de lo esperado, después de que se anunció buenos resultados para el tercer trimestre (crecimiento de los ingresos del 24,6% a aproximadamente € 382 700 000). El Ebitda aumentó un 33,8% a aproximadamente 137,2 millones de euros, mientras que el beneficio neto es de 97,4 millones. Para el año 2014, Pandora espera que los ingresos de 1540 millones de euros y un Ebitda de más del 35%. Pandora recibe las mejores ofertas en la región Asia-Pacífico, con un salto de 40,5%, Europa (+ 27,4%) y América (+ 17,8%). Para 2014, 300 nuevas aperturas de tiendas están planeado (en comparación con la expectativa anterior de 275).

Evidentemente satisfecho con el Ceo, Allan Leighton, “Estamos muy contentos de haber cerrado otro trimestre con un rendimiento significativo, reportando nuestros ingresos más alto y el Ebitda, jamás registrado hasta ahora y todas las regiones han seguido un buen desempeño, gracias a la expansión de la red de tiendas, y nuevas líneas de productos”, dijo.

Stroili sarà venduta a un indiano

Published on

Una notizia clamorosa scuote il mondo del gioiello: Stroili diventa indiana. Secondo quanto scrive il solitamente bene informato Carlo Turchetti sul Corriere Economia, Stroili Oro sta per essere venduta al fondo Emerisque. Si tratta di un fondo fondato e diretto da Ajay Khaitan, indiano con residenza britannica. Il negoziato sarebbe alle fasi conclusive e potrebbe essere portato a termine entro novembre, cioè nel giro di 15 giorni. Il prezzo di acquisto non è ancora noto, ma si parla di una cifra intorno a 300 milioni, più del fatturato (230 milioni). L’indiano Khaitan avrebbe così superato in corsa gli altri due pretendenti della catena di preziosi guidata da Maurizio Merenda, che conta su una distribuzione di 370 negozi. Insomma, gli altri in lizza, il fondo italiano Clessidra di Claudio Sposito, che si avvale dell’esperienza dell’ex amministratore di Bulgari, Francesco Trapani, così come i russi di Vtb, che stanno acquistando Roberto Cavalli, hanno perso la corsa. A vendere sono, ovviamente, i soci di Stroili: il fondo Investindustrial di Andrea Bonomi (che detiene il 31% in via indiretta), Intesa Sanpaolo (12%), 21 Investimenti (cioè i Benetton, con circa 9%) e Wise sgr (circa 9%). A questi, con quote minori, si aggiungono il fondo Ergon, il finanziere Francesco Micheli e i De Nora. Emerisque lo scorso anno ha acquisito da Permira i marchi Mcs. Federico Graglia

![]() Stroili will be bought by an Indian

Stroili will be bought by an Indian

A bombshell shakes the world of jewelry: Stroili will become by a Indian businessman. As he writes the usually well-informed Carlo Turchetti on the Corriere Economia, Stroili Oro is going to be sold to the fund Emerisque. This is a fund established and managed by Ajay Khaitan, a Indian which lives in Britain. The talks would be in the final stages and would be completed by November, that is, within 15 days. The purchase price is not yet known, but it comes to a figure of around 300 million more that the revenues (230 million). And so Khaitan is exceeding the other two contenders in the running of the chain of precious driven by Maurizio Merenda, which has a distribution of about 370 shops. In short, the others lost the race: the Italian fund Clessidra of Claudio Sposito, which is helped by the former director of Bulgari, Francesco Trapani, as well as Russia’s VTB fund, that it’s buying Roberto Cavalli. The sellers are, of course, the Stroili shareholders: the fund Investindustrial Andrea Bonomi (which owns 31% indirectly), Intesa Sanpaolo (12%), 21 Investimenti (Benetton group, with about 9%) and Wise SGR (about 9%). And the others with lower odds: Ergon, the financier Francesco Micheli and De Nora. Emerisque last year acquired by Permira the brands MCS.

![]() Stroili sera acheté par un Indien

Stroili sera acheté par un Indien

Une bombe secoue le monde de la joaillerie: Stroili sera acheté par un homme d’affaires indien. Comme écrit Carlo Turchetti, généralement bien informé, sur le Corriere Economia, Stroili Oro va être cédé au fonds Emerisque. Ceci est un fonds créé et géré par Ajay Khaitan, un Indien qui vit en Grande-Bretagne. Les négociations seraient dans la phase finale et sera achevée d’ici Novembre, qui est dans les 15 jours. Le prix d’achat est pas encore connu, mais il est livré à un chiffre d’environ 300 millions de plus que les recettes (230 millions). Et si Khaitan dépasse les deux autres prétendants à la gestion de la chaîne de précieux entraîné par Maurizio Merenda, qui a une distribution d’environ 370 magasins. En bref, les autres dans la course ont perdu: le fonds italien Clessidra de Claudio Sposito, qui est aidé par l’ancien directeur de Bulgari, Francesco Trapani, ainsi que le fonds VTB de Russie, qu’il achète Roberto Cavalli. Les vendeurs sont, bien sûr, les actionnaires Stroili: le fonds Investindustrial Andrea Bonomi (qui détient 31% indirectement), Intesa Sanpaolo (12%), 21 Investimenti (groupe Benetton, avec environ 9%) et Wise SGR (environ 9%) . Et les autres avec des cotes inférieures: Ergon, le financier Francesco Micheli et De Nora. Emerisque année dernière acquisition par Permira les marques MCS.

![]() Stroili wird von einem indischen gekauft werden

Stroili wird von einem indischen gekauft werden

Eine Bombe erschüttert die Welt des Schmucks: Stroili wird von einem indischen Geschäftsmann geworden. Wie auf der Corriere Economia schreibt er das in der Regel gut informiert Carlo Turchetti, wird Stroili Oro geht an den Fonds Emerisque verkauft werden. Dies ist eine etablierte und von Ajay Khaitan, einem indischen, der in Großbritannien lebt verwalteten Fonds. Die Gespräche würden in der Endphase und würde bis November abgeschlossen sein, das heißt, innerhalb von 15 Tagen. Der Kaufpreis ist noch nicht bekannt, aber es auf einen Wert von rund 300 Millionen mehr kommt, dass die Einnahmen (230 Mio. Euro). Und so Khaitan wird, die über die beiden anderen Konkurrenten in der Lauf der Kette von Edel von Maurizio Merenda, die eine Verteilung von etwa 370 Geschäften hat angetrieben. Kurz gesagt, die anderen verlor das Rennen: die italienische Fonds Clessidra von Claudio Sposito, die durch den ehemaligen Direktor des Bulgari, Francesco Trapani, sowie Russlands VTB Fonds geholfen wird, dass es den Kauf von Roberto Cavalli. Die Verkäufer sind, natürlich, die Stroili Aktionäre: Der Fonds Invest Andrea Bonomi (die 31% indirekt), Intesa Sanpaolo (12%), 21 Investimenti (Benetton-Gruppe, mit etwa 9%) und Wise SGR (ca. 9%) . Und die anderen mit niedrigeren Gewinnchancen: Ergon, der Finanzier Francesco Micheli und De Nora. Emerisque letzten von Permira die Marken MCS erworben Jahr.

AБомба сотрясает мир ювелирных изделий: Stroili станет на индийский бизнесмен. Как он пишет, как правило, хорошо информированного Карло Turchetti на Corriere Economia, Stroili Oro будет продаваться в фонд Emerisque. Это фонд, созданный и управляемый Аджай Khaitan, в Индии, которая живет в Великобритании. Переговоры бы в завершающей стадии и будет завершено к ноябрю, то есть, в течение 15 дней. Покупная цена пока не известна, но речь идет о фигуре около 300 миллионов больше, что доходы (230 млн). И так Khaitan превышает двух других соперников в управлении цепи драгоценный обусловлен Маурицио Merenda, которая имеет распределение около 370 магазинов. Короче, другие в гонке проиграл гонку: итальянский фонд Clessidra Клаудио Спозито, который помог бывшим директором Bulgari Франческо Трапани, а также фонд ВТБ в России, что она покупает Роберто Кавалли. Продавцы, конечно, акционеры Stroili: фонд Investindustrial Андреа Бономи (владеет 31% опосредованно), Intesa Sanpaolo (12%), 21 инвестиции (группа Benetton, с около 9%) и Wise SGR (около 9%) , А остальные с более низкими шансы: Ergon, финансиста Франческо Микели и De Nora. Emerisque прошлом году приобретена Permira брендами MCS.

![]() Stroili será comprada par Ajay Khaitan

Stroili será comprada par Ajay Khaitan

Una bomba sacude el mundo de la joyería: Stroili se convertirá en un businessman de la India. Como escribe el generalmente bien informado Carlo Turchetti en el Corriere Economia, Stroili Oro va a ser vendido al fondo Emerisque. Este es un fondo creado y administrado por Ajay Khaitan, un hombre de la India que vive en Gran Bretaña. Las conversaciones estarían en las etapas finales y se completaría en noviembre, es decir, dentro de 15 días. El precio de compra no se conoce todavía, pero se trata de una cifra de alrededor de 300 millones de dólares más que los ingresos (230 millones). Y así Khaitan está excediendo los otros dos contendientes en la gestión de la cadena de preciosos impulsada por Maurizio Merenda, que tiene una distribución de cerca de 370 tiendas. En resumen, los otros en la carrera perdió: el fondo Clessidra italiana de Claudio Sposito, que está ayudado por el ex director de Bulgari, Francesco Trapani, así como fondos de VTB de Rusia, que está comprando Roberto Cavalli. Los vendedores son, por supuesto, los accionistas Stroili: el fondo de Investindustrial Andrea Bonomi (que posee el 31% de forma indirecta), Intesa Sanpaolo (12%), 21 Investimenti (grupo Benetton, con alrededor del 9%) y Wise SGR (alrededor del 9%) . Y los otros con probabilidades más bajas: Ergon, el financiero Francesco Micheli y De Nora. Emerisque año pasado adquirida por Permira las marcas MCS.

Se i diamanti brillano meno

Published on

Nel caso vogliate acquistare diamanti, magari come investimento, sappiate che al momento il prezzo è in calo. Ne dà notizia Rapaport, la bibbia dei diamanti lavorati. Il prezzo in calo è determinato da diversi fattori: domanda debole, ridotto credito bancario e aumento dell’offerta. Gli esperti Usa indicano un calo del prezzo dei brillanti da 1 carato nell’ordine del 6% negli ultimi 12 mesi. A questa frenata si sono aggiunte, inoltre, le recenti festività religiose in Israele e in India, che hanno rallentato le vendite. Sempre secondo Rapaport, i prezzi dei diamanti De Beers sono rimasti sostanzialmente stabili, ma la domanda debole dovrebbero influenzare negativamente le quotazioni di mercato nei prossimi mesi. Insomma, si prevedono nuovi ribassi. Anche perché il mercato asiatico sembra tiepido, con segnali di stanchezza. Non è chiaro se la crescita delle vendite durante le vacanze di natale sarà sufficiente per cambiare la situazione: secondo gli esperti americani, per produttori e commercianti la situazione è «preoccupante». Federico Graglia

In case you want to buy diamonds, perhaps as an investment, you should know that now the prices are falling. The news is by Rapaport, the Bible of diamonds. The price decrease of polished diamonds are determined by several factors: weak demand, reduced bank lending and increased supply. The US experts indicate a decline in the price of diamonds of 1 carat in the order of 6% in the last 12 months. And this is added at the recent religious holidays in Israel and India, which have slowed sales. Also according to Rapaport, the De Beers diamond prices have remained fairly stable, but weak demand can would adversely affect the market prices in the coming months. In short, we can wait new markdowns. Also because the Asian market seems tepid, with signs of fatigue. It is not clear if the increase in sales during the Christmas holiday will be enough to change the situation. According to American experts, the situation is “worrisome” for producers and traders.

![]() Si les diamants brillent moins

Si les diamants brillent moins

Dans le cas où vous souhaitez acheter des diamants, peut-être comme un investissement, vous devez savoir que maintenant les prix sont en baisse. Les nouvelles sont par Rapaport, la Bible de diamants. La diminution de prix de diamants sont est par plusieurs facteurs: faiblesse de la demande, la réduction des prêts bancaires et l’augmentation de l’offre. Les experts américains indiquent une baisse du prix des diamants de 1 carat de l’ordre de 6% au cours des 12 derniers mois. Et cela est ajouté lors des récentes fêtes religieuses en Israël et en Inde, qui ont ralenti les ventes. Selon Rapaport, les prix du diamant De Beers sont restés assez stables, mais la faible demande peuvent se nuire aux prix du marché dans les mois à venir. En bref, nous pouvons attendre de nouvelles démarques. Aussi parce que le marché asiatique semble tiède, avec des signes de fatigue. On ne sait pas si l’augmentation des ventes pendant les vacances de Noël sera suffisant pour changer la situation. Selon les experts américains, la situation est “préoccupante” pour les producteurs et les commerçants.

![]() Wenn Diamanten funkeln weniger

Wenn Diamanten funkeln weniger

Falls Sie Diamanten kaufen, vielleicht als eine Investition, sollten Sie wissen, dass nun die Preise fallen wollen. Die Nachricht ist von Rapaport, der Bibel, der Diamanten. Schwache Nachfrage, geringere Kreditvergabe der Banken und erhöhte Versorgung: Der Preisrückgang von geschliffenen Diamanten werden von mehreren Faktoren bestimmt. Die US-Experten zeigen einen Rückgang der Preise von Diamanten von 1 Karat in der Größenordnung von 6% in den letzten 12 Monaten. Und dies ist bei den jüngsten religiösen Feiertage in Israel und Indien, die Verkaufs verlangsamt haben zugegeben. Auch nach Rapaport, haben die De Beers Diamantenpreise relativ stabil geblieben, aber die schwache Nachfrage kann sich nachteilig in den kommenden Monaten die Marktpreise beeinflussen. Kurz gesagt, können wir neue Abschläge warten. Auch, weil der asiatische Markt scheint lauwarm, mit Anzeichen von Müdigkeit. Es ist nicht klar, ob die Umsatzsteigerung während der Weihnachtsfeiertage ausreichen werden, um die Situation zu ändern. Laut US-amerikanischen Experten, ist die Situation “besorgniserregend” für Produzenten und Händler.

![]() Если бриллианты сверкают менее

Если бриллианты сверкают менее

В случае, если вы хотите купить бриллианты, возможно, в качестве инвестиций, вы должны знать, что в настоящее время цены падают. Новость по Рапапорт, Библии алмазов. Снижение цен бриллиантов определяются несколькими факторами: низким спросом, снижение банковского кредитования и увеличения предложения. Американские эксперты указывают на снижение цен на алмазы в 1 карат в порядка 6% в течение последних 12 месяцев. И это добавляется в последние религиозных праздников в Израиле и Индии, которые замедлили продаж. Кроме того, согласно Рапапорт, цены на алмазы De Beers остались довольно стабильными, но слабый спрос может отрицательно повлиять на рыночные цены в ближайшие месяцы. Короче говоря, мы можем ждать новых скидок. Также из-за азиатский рынок, кажется прохладной, с признаками усталости. Пока не ясно, если рост продаж в течение Рождества будет достаточно, чтобы изменить ситуацию. По мнению американских экспертов, ситуация “тревожная” для производителей и торговцев.

![]() Si los diamantes brillan menos

Si los diamantes brillan menos

En caso de que quiera comprar diamantes, tal vez como una inversión, usted debe saber que los precios están bajando. La noticia es por Rapaport, la Biblia de los diamantes. La disminución de los precios de los diamantes están determinados por varios factores: la debilidad de la demanda, la reducción de los préstamos bancarios y el aumento de la oferta. Los expertos estadounidenses indican un descenso en el precio de los diamantes de 1 quilate en el orden del 6% en los últimos 12 meses. Y esto se añade a las recientes fiestas religiosas en Israel y la India, que han frenado las ventas. También de acuerdo con Rapaport, los precios de los diamantes De Beers ha mantenido bastante estable, pero la débil demanda se afectarían negativamente a los precios de mercado en los próximos meses. En resumen, podemos esperar nuevas rebajas. También porque el mercado asiático parece tibia, con signos de fatiga. No está claro si el aumento de las ventas durante las vacaciones de Navidad será suficiente para cambiar la situación. Según los expertos estadounidenses, la situación es “preocupante” para los productores y comerciantes.

Usa rings for the Chinese Chow Tai Fookk

Published on

Chinese jewelers who buy engagement rings Americans. In short, marriage is between Chow Tai Fook, large group listed on the Hong Kong Stock Exchange, and the american Hearts On Fire. Price paid out by the Chinese for 100% of Hearts on Fire: $ 150 million (approximately € 110 million) in cash. Hearts On Fire was founded in 1996 by Glenn and Susan Rothman is a jewelry store that specializes precisely in engagement rings, like the classic solitaire diamond with medium-high prices range: 75% has a cost to the public between the thousand and 10 thousand dollars. Last year, the company had revenues of $ 104.8 million. Now the rings Americans Hearts On Fire will be sold in the boutiques of Chow Tai Fook in China and, more generally, in the rest of Asia. The shopping of the Chinese, however, is only for the United States. It will take a little time, probably, to see some Italian company in the crosshairs of the Asian groups. On the other hand, the brand of Valencia Stefan Hafner, is already a leader in the Indian giant Gitanjali Group.

It is a good business to invest in jewelry

Published on

[wzslider]

Investing in jewelry is a real bargain. Especially in times of economic turbulence, such as what we live for a few years. It supports the Monte dei Paschi di Siena, which has carried out a study on the art market and that of precious metals. The survey analyzes the art market of the MPS market performance of painting, divided into three segments of reference, summarizing the results of the largest transactions of auction houses ( about 1,550 observations total) in three indices according to the period historical reference : MPS Art Old masters and 19th century Index, MPS and MPS Index Art Pre War Post War Art Index. The evidence of the 3 indices are then summarized in the Global MPS Painting Art Index.

But, as anticipated, the discussion does not end here. Experts have also introduced indexes that aim to analyze the trend of so-called minor arts : antiques, furniture and sculptures, jewelry, wine and photography. Within the minor arts, we analyzed the performance of the sector Jewels compared to other minor arts given the particular function as a safe haven covered in this segment.

The most important segment after painting, in fact, is represented by jewelry and watches, whose temples stand out for their high average turnovers and weighs a total of 14.2% of total revenues ( +3.1% compared to the portion of the first half 2010). This segment is expected to grow further by the experts of MPS, especially given the success that the rods of precious stones and are enjoying all the squares on the continent.

Conclusions : The weight between the various segments still seems to be intended to change, with a strengthening of the minor arts that show, in just the last calendar year and in all categories, the best performance in terms of percentage changes compared to the MPS Global Painting Art Index.

The MPS Jewels index summarizes the trend of the auctions of jewelery, watches and precious stones of the most important international centers : Geneva, London, New York and Hong Kong. The segment shows the growth rates of the most interesting segment of the minor arts, with an increase of 160.8 % over the last 5 years ( first half of 2011 over the first half of 2006).

In comparison with the MPS Minor Arts Index Without Jewels ( +71.0 % between 2006 and 2011 ), it is evident success of the jewelery, which at the moment are confirmed safe haven par excellence, with a performance estimate for 2011 +10, 0% (latest data considered in the study ).

The jewelry will also reveal a rather good ‘liquid’, at least for the high quality pieces : the rods considered to show that the branded jewelery or antiques are a safe investment. In addition to diamonds are always very popular natural stones ( untreated) and natural pearls (not cultivated ). The success of the segment can be attributed to two main reasons: 1 ) the jewelry is seen as a safe haven warranty, and 2) the value of the underlying ( gold, silver, diamond… ) has grown significantly in this period of recession.

Of course, it is not automatically sell a gem, but no more than a painted picture. The unsold rates recorded in the last five semesters, note analysts Sienese bank, settle in the region of the five-year average rates ( average rate per lot 21.4%, 17.6% by value ), and below the peaks achieved in 2008 : the market in the last two years seems to have found a sustainable balance for supply and demand.

Compared to the past, the demand for precious focuses more on top quality diamonds, colored stones with particular as to the Burmese rubies, Kashmir sapphires and for the Colombian (Muso ) for emeralds.

On the square in New York are appreciated especially great carat white diamonds, as well as large colored stones and colored diamonds. The jewels of the ’20s and ’50s are very welcome in both the old and the new continent. The UK market is more geared towards the cushion cut diamonds for their particular for their luster and charm. In Italy is more and more interest in the vintage jewelry, thanks to a consolidated goldsmith tradition that has produced manufacturing, design and proportions of high quality. The signatures, known internationally, they add value to the jewel with exquisite designs and a perfect bill.

There are, finally, advice for those who decide to embark on an investment in diamonds. It is necessary, experts explain, evaluate the so-called 4 C’s : color ( color), purity ( Clarity ), cut ( Cut) and carat ( Carat ). Not to be overlooked, moreover, proportions, fluorescence and polishing.

The market for fine jewelry is synthesized in a series of graphs. The performance of the MPS Jewels Market Value Index in the entire observation period (September 2008 – September 2011) is quite positive ( +63.5 %) and superior to other national stock indices considered, all in negative territory : SMI ( -4, 9%), CAC 40 ( -36.7 %) ** and FTSE MIB ( -54.5 %) with the exception of S & P 500 ( +2.7%).

The investment in the stock market jewel of luxury appears to be the only positive with respect to the major indices which are representative of 4 -contributing countries, with their society, the definition of MPS Jewels Market Value Index ( Damiani and Bvlgari for Italy, LVMH, Hermès and Dior for France to Switzerland Richemont and Tiffany & Co. for the United States ).

Be careful, though : the dangers out there. The segment of the jewel of luxury, the study continues, it is subjected to numerous threats : 1 ) increasingly strong interest in substitute goods to meet the psycho – physical (eg, travel, spas, gyms, etc. ), 2) increased demand for the productions of the fashion industry, especially by younger people, attracted by prices less prohibitive and innovative features, and 3) preference for fashion products than for products – value ; 4) strong seasonality of sales in some periods of the year ( for jewelry Christmas and Valentine’s Day ), 5 ) the risk of counterfeiting; 6) reputational risk ( for example, when the production is decentralized abroad ) ; 7) change in consumer tastes, often sudden and unreasoned.

The high rates of unemployment and the levels of tax rates in emerging markets are factors that can influence demand. Moreover, the products of the luxury market have good nature of secondary ones, which makes them susceptible to the macroeconomic environment and require a constant upgrading and re-launching the brand.

This is also why in recent months the performance of MPS Jewels Market Value Index was affected by the difficulties in the financial markets ( -20.5 %), but were also negative performance of all other indices ranging from -31.9 % of FTSE MIB to -10.7% for the S & P500.

On the overall performance of the MPS Jewels Market Value Index, however, have impacted primarily LVMH ( -19% approx. ) And Richemont (-23% approx. ) Which together account for about 70%. the entire index.

Little significant effect on the growth performance of the title Bulgari (+50% approx. ) Following the tender offer launched by LVMH, because of its limited weight on the aggregate (4.5% approx. ).